IIETAI

Page 48

Page 49

If you've noticed an error in this article please click here to report it so we can fix it.

ike coal, steel was once a powerful force in British industry. But since the end of the 196os and the dying days of the old nationalised steel industry, the story has been one of almost constant decline. Since that time it's esti

mated that nine out of to UK steel jobs have simply disappeared.

Yet in some parts of the country a slimmed-down steel industry is still the only 'viable yiable source of employment. While the ajority of this work is on the manufachirg or processing side, the income from transporting steel goods still provides yak'. .. able revenue for many haulage firms bordering major steel plants.

l' The latest uncertainty for steel hauliers ;comes little over a year after the last major ihockwave, when Anglo-Dutch steel giant Corns announced it was cutting more than IS,000 jobs as part of a drastic restructuring. . At the time, some steel hauliers—particurly those concentrated around Corus' pro: uction facilities in Wales—warned they aced serious downsizing of fleets and possile cutbacks in staff as a result of the steel . 'giant's job cuts.

But one year on, it appears that while some hauliers have abandoned steel, others have actually been expanding.

However, Cardiff-based Castle Services has witnessed a major decline in the amount of its business that is dependent on steel, from as much as 75% before the Carus cutbacks to just 25% now.

"The old British Steel was a major customer of ours and it was good work," says transport manager Hugh Coles. "The drivers liked it and we liked it but the trouble was we had all our eggs in one basket. We should have had more foresight five or six years ago but we rested on our laurels."

Food products

Nonetheless the company has managed to successfully diversify. Now it relies less on steel and is expanding heavily into the automotive industry. But its other contracts include everything from food products to drinking water, and after being bought out in July last year by the French national rail firm SNCF it is currently exploring several other opportunities.

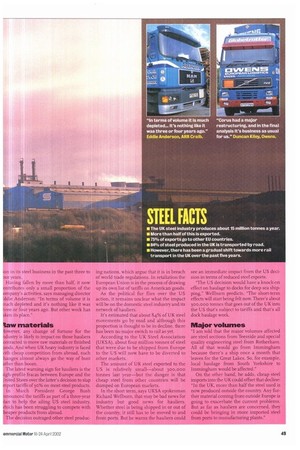

By way of contrast, Owens of Llanelli, which combines steel transport with other types of haulage, now claims to be shiftini "more steel than ever before".

After the fall-out from last year's Com: cutbacks—and the restructuring that fol lowed—Owens was retained as one of au company's preferred distributors. Sine( then, says general manager Duncan Kiley things have got better and better.

"We are expanding," he says. "In fact I arr just writing out applications for some nev operator centres. It's true we were a little bi concerned but in the past year we hay( expanded our fleet by about ro%.

"Corns had a major restructuring and ir the final analysis it's business as usual for us We now have in excess of 200 vehicles— from vans to 44tonners—and stee accounts for about 30% of our business."

This growth, Kiley adds, has been across the board, but steel has certainly played it part. As for the US tariffs, such is the confi dence within the company at the momen that there is little or no concern that any deci sions taken in Washington will do any dam age in Llanelli.

But not all steel hauliers are in this fort-u nate situation. Aberdeen-based firm ARF Craib is one that has seen a marked reduc 1.1t, In n its steel business in the past three to years. aving fallen by more than half, it now tributes only a small proportion of the pany's activities, says managing director e Anderson: In terms of volume it is h depleted and it's nothing like it was e or four years ago. But other work has ken its place."

qtaw materials

iowever, any change of fortune for the ndustry is likely to impact on those hauliers on tracted to move raw materials or finished ;oods. And when UK heavy industry is faced vith cheap competition from abroad, such hanges almost always go the way of bust ather than boom.

The latest warning sign for hauliers is the i.gh-profile fracas between Europe and the Jnited States over the latter's decision to slap wort tariffs 0130% on most steel products. In March President George Bush nnouncect the tariffs as part of a three-year an to help the ailing US steel industry, tiltich has been struggling to compete with heaper products from abroad.

The decision outraged other steel produc

ing nations, which argue that it is in breach of world trade regulations. In retaliation the European Union is in the process of drawing up its own list of tariffs on American goods.

As the political fur flies over the US action, it remains unclear what the impact will be on the domestic steel industry and its network of hauliers.

It's estimated that about 84% of UK steel movements go by road and although this proportion is thought to be in decline, there has been no major switch to rail as yet.

According to the UK Steel Association (UKSA), about four million tonnes of steel that were due to be shipped from Europe to the US will now have to be diverted to other markets.

The amount of UK steel exported to the US is relatively small—about 300,000 tonnes last year—but the danger is that cheap steel from other countries will be dumped on European markets.

In the short term. says UKSA spokesman Richard Wellburrn that may be bad news for industry but good news for hauliers. Whether steel is being shipped in or out of the country, it still has to be moved to and from ports. But he warns the hauliers could see an immediate impact from the US decision M terms of reduced steel exports.

"The US decision would have a knock-on effect on haulage to docks for deep sea shipping," Wellburri predicts. "The short-term effects will start being felt now. There's about 300,000 tonnes that goes out of the UK into the US that's subject to tariffs and that's all dock haulage work.

Major volumes

"I am told that the major volumes affected are steel sections from Teesside and special quality engineering steel from Rotherham. All of that would go from Immingham because there's a ship once a month that leaves for the Great Lakes. So, for example, local haulage from South Yorkshire to Immingham would be affected," On the other hand, he adds, cheap steel imports into the UK could offset that decline: "In the UK, more than half the steel used is now produced outside the country. Any fur.titer material coming from outside Europe going to exacerbate the current problem. But as far as hauliers are concerned, th could be bringing in more imported ste. from ports to manufacturing plants,"