Delicate shoots

Page 20

If you've noticed an error in this article please click here to report it so we can fix it.

The Freight Transport Association's Quarterly Transport

Actin-1y Survey shows domestic freight continues to rise.

But is this growth sustainable? Jennifer Ball finds out

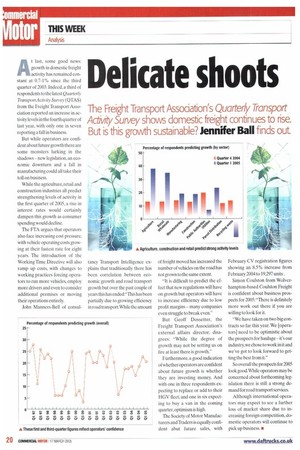

At last, some good news: growth in domestic freight activity has remained constant at 0.7-1% since the third quarter of 2003. Indeed, a third of respondents to the latest Quarterly TransportActivity Survey (QTAS) from the Freight Transport Association reported an increase in activity levels in the fourth quarter of last year, with only one in seven reporting a fall in business.

But while operators are confident about future growth there are some monsters lurking in the shadows new legislation, an economic downturn and a fall in manufacturing could all take their toll on business.

While the agriculture, retail and construction industries all predict strengthening levels of activity in the first quarter of 2005, a rise in interest rates would certainly dampen this growth as consumer spending would decline.

The FTA argues that operators also face increasing cost pressure, with vehicle operating costs growing at their fastest rate for eight years. The introduction of the Working Time Directive will also ramp up costs, with changes to working practices forcing operators to run more vehicles, employ more drivers and even to consider additional premises or moving their operations entirely.

John Manners-Bell of consul tancy Transport Intelligence explains that traditionally there has been correlation between economic growth and road transport growth but over the past couple of years this has ended:"This has been partially due to growing efficiency in road transport.While the amount of freight moved has increased the number of vehicles on the road has not grown to the same extent.

-It is difficult to predict the effect that new regulations will have on growth but operators will have to increase efficiency due to low profit margins many companies even struggle to break even."

But Geoff Dossetter, the Freight Transport Association's external affairs director, disagrees: "While the degree of growth may not be setting us on lire at least there is growth."

Furthermore, a good indication of whether operators are confident about future growth is whether they are investing money. And with one in three respondents expecting to replace or add to their HGV fleet, and one in six expecting to buy a van in the coming quarter, optimism is high.

The Society of Motor Manufacturers and Traders is equally confident abut future sales, with February CV registration figures showing an 8.5% increase from February 2004 to 19,297 units.

Simon Coulston from Wolverhampton-based Coulston Freight is confident about business prospects for 2005: "There is definitely more work out there if you are willing to look for it.

"We have taken on two big contracts so far this year. We [operators] need to be optimistic about the prospects for haulage it's our industry, we chose to work in it and we've got to look forward to getting the best from it."

So overall the prospects for 2005 look good. While operators may be concerned about forthcoming legislation there is still a strong demand for road transport services Although international operators may expect to see a further loss of market share due to increasing foreign competition, domestic operators will continue to pick up business. •