An Operating Cost

Page 38

Page 39

Page 40

If you've noticed an error in this article please click here to report it so we can fix it.

ccords Quiz.

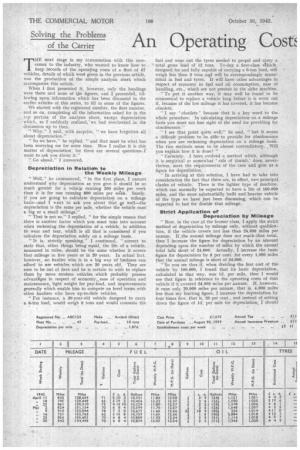

THE next stage in my conversation with this newcomer to the industry, who wanted to know how to keep records of the operating costs of a fleet of 67 vehicles, details of which were given in the previous article, was the production of the simple analysis sheet which

accompanies this article. .

When I first presented it, however, only the headings were there and none of the figures, and I proceeded, flulowing upon information which has been discussed in the earlier articles of this series, to fill in some of the figures.

We started with the registered number, the fleet number, and so on, completing all the information asked for in the top portion of the analysis sheet, except depreciation which, as I suddenly realized,' we had overlooked in the discussion up to then.

"Why," I said, with surprise, " we have forgotten all about depreciation."

" So we have," he replied, " and that must be what has been worrying me for some time. Now I realize it is this, matter of depreciation, for there are several questions. I want to ask you about it."

"Go ahead," I answered. .

Depreciation in Relatien to the Weekly Mileage " Well," he commenced, " in the first place, I cannot understand why depreciation as you give it should be so much greater for a vehicle running 200 miles per week than it is for one running 800 miles per week. Surely,

•• if you are going to calculate depreciation on a mileage basis-an.d I want to ask you about that is well-the depreciation is the same per mile, whether the vehicle runs

a big or a small mileage."

" That is not so," I replied, "for the simple reason that there is another factor which you must take into account when reckoning the depreciation of a vehicle, in addition to wear and tear, which is all that is considered if you calculate the depreciation solely on a mileage basis.

" It is, strictly speaking," I continued, "correct to state that, other things being equal, the life of a vehicle, measured in miles, should be the same whether it covers that mileage in five years or in 20 years. In actual fact, however, no haulier who is in a big way of business can afford to use vehicles which are 20 years old. They are sure to be out of date and he is certain to wish to replace them by more modern vehicles which probably possess advantriges in respect of economy,,, ease of operation and maintenance, light weight for pay-load, and improvements generally which enable him to compete on level terms with other hauliers who have up-to-date vehicles, " For instance, a 20-year-o1d vehicle designed to carry 6-ton load, would weigh 6 tons and would consume the fuel and wear out the tyres needed to propel and carry a total gross load of 12 tons. To-day a first-class vhicle, 'designed for and fully capable of carrying a 6-ton load, will weigh less than 3 tons aid will be correspondingly econo: mical in fuel and tyres. It will have other advantages in respect of economy in fuel and oil consumption, ease of handling, .etc., which are not present in the older machine.

" To put it another way, it may well be found to be economical to replace a vehicle long before it is worn out if, because of the low mileage it has covered, it has become obsolete.

" I say ' obsolete ' because that is a key word to the whole procedure. In calculating depreciation. on a mileage basis you must not lose sight oi the need for providing for obsolescence.''

" I see that point quite well," he said, "hut it seems a difficult problem to be ableto provide for obsolescence when you are reckoning depreciation on a mileage basis. The two methods seem to be almost contradictory. Will you explain how it is done? "

"Certainly. I have evolved a method which, although it is empirical or somewhat 'rule of thumb,' do-es nevertheless, meet the requirements of the case and give us a figure for depreciation.

"In arriving at this solution, I have had to take into consideration the fact that there are, in effect, two principal clasges of vehicle. There is the lighter type of machine, which can normally be expected to have a life of 100,000 miles, and the More substantially built and 'heavier vehicle of the type we have just been discussing, which can be expected to last for double that mileage.

Strict Application of Depreciation by Mileage " Now, in the case of the former class, I apply the strict method of depreciation by mileage only, without qualification, if the vehicle covers not less than 24,000 miles per annum. If ;the annual mileage does not .reach that total, then I increase the figure for depreciation by an amount depending upon the number of miles by which the annual total falls short of 24,000. Actually, I increase the basic -figure for depreciation by 5 per cent, for every 1,000 miles that the annual mileage is short of 24,000.

"So you see that if, when dividing the first cost of the vehicle by 100,000, I found that its basic depreciation, calculated in that way, was Id. per mile, then I would use that figure in reference to the operating costs of that vehicle if it coveted 24,000 miles per annum. If, however, it runs only 20,000 miles per annum, that is, 4,000 miles less than my limiting figure, I increase the depreciation by four times five, that is, 20 per cent., and instead of setting down the figure of ld. per mile for depreciation, I should advise that it be depreciated at the rate of 1..2d. per mile, " In the case of the heavier type of vehicle, the basic mileage depreciation is calculated on a life of 200,000 miles, but that applies strictly only if the annual mileage reaches 48,000, and I increase that basic figure for depreciation by .S per cent. for every 2,000 miles that the annual mileage is short of 48,000 " We can illustrate the method in reference to. the more substantial type of vehicle by working out the figure foi depreciation for this IO-tonner, the operating costs records of which we are setting out on this sheet.

" In the first place, the initial cost we agreed was £1,675. From that I take away the cost of a set of tyres, £125, leaving £1,550."

"Why do you do that? Why do you deduct the price?"

Reason Why the Price of Tyres is Deducted

"Because we have made provision . elsewhere in the operating costs records for the depreciation of the tyres and if we don't deduct this initial amount of £125 we are going to charge that depreciation of tyres twice over. so far as the first set of tyres is concerned." • " I see, That makes the point clear."

"Well then, we have a net figure of £1,550 from which we must calculate our depreciation. We assume that the vehiclels to be discarded or replaced when it has completed 200,000 miles. At the end of that time, however, there • is no doubt that the operator will obtain something for it in part exchange. Let,us assume, for the sake of argument, that the ' residual value,' as it is called, is £250. That means the actual cost of the 200,000 miles of running, in so far as depreciation is concerned, totals £1,300. If that be reduced to pence and divided by 200,000 we get 1.58d. per mile as the basic figure for depreciation as calculated on a mileage basis.

" Now, suppose this vehicle runs 40,000 miles per annum, that is 8,000 less than the limiting figure of 48,000, the basic amount of depreciation mustbe increased by 5 per cent, for every 2,000 miles, so that the total increase must be 20 per cent. Adding that percentage to 1.56k1. gives I.87d. and that is the amount I propose to set down in the space marked ' depreciation ' in the upper portion of this simple analysis $ieet."

" I am still worried," he said, " about the idea of charging depreciation on a mileage basis. Since we had our last talk T have been looking into some of our office figures and I see that the vehicles are depreciated bver four years, irrespective of the mileage they do,"

," That is quite a common practice," I interrupted, "and is satisfactory to a certain extent and in application to only • certain -well-defined classes of business." " What classes? " he came back. " I must ask that question because if I am going to suggest to the boss that I alter this method of recording depreciation I shall have to justify Myself." "I don't mind you asking at all," I said.' " Indeed, I would rather you did because I don't want you to go away without fully understanding all that I am recommending."

" The class of business in which it is quite satisfactory to record depreciation. in that way is, admittedly, one like that of the firm who have just engaged you, that is, a well-established business with a large fleet and doing a fairly regular turnover all the year' round.

" Obviously, if the vehicle covers about 800 miles every week, the figure for depreciation is the same week by week and might just as well be treated as a standing charge."

" Perhaps it would make it easier for me," he suggested, " if you would indicate the kind of business where it would not be so satisfactoryto take depreciation as a standing charge or, at least, where it would be preferable to use the mileage basis for calculation."

Why the Small Hau tier Should • Depreciate on a Mileage Basis •

" It is infinitely better,", I said, "for the small haulier to assess depreciation on a mileage basis, especially if his business and the mileage his vehicles do fluctuate fairly widely throughout the year. .•

" Actually,', I added, " tliis aspect of the matter was brought very forcibly to my mind when I was asked by a haulier, with half-a-dozen vehicles, to look over his costing system. He wasn't very happy about it, because, according to his current figures, he seemed to be losing money. Nevertheless, be knew, from past experience, that his business was no worse than it had. been in .previous years and he had been in the habit of making a satisfactory net profit every year.

"Now, I should explain that this man' S vehicles were all of the larger type, worth about £2,000 apiece, hut that his business was of the kind which involved considerable mileages, as much as 1,000 per week or more for every vehicle, for about eight months in the year. Then, from .February to May, the particular traffic in which he was interested fell off, and as his road licence operated to prevent him making any change, there was no way in which he could remedy that disadvantage.

" I cannot remember the exact figures. hut I will give you some which are hypothetical, to show you how it comes about that, in such -circumstances, it is preferable

to record depreciation on a mileage basis. If I exaggerate the figures a little so as to emphasize the importance of the matter, I am sure you won't object.

" He had the same idea as your boss about depreciation. He was wiping his vehicles off his books over a period of four years, that is to say, depreciating at the rate of 25 per cent. per annum. Thus, the total annual depreciation was six times £500, which is £3,000, approximately £60 per week. In the busy season these vehicles ran 1,000 miles Kier week. The operating costs of the vehicles were approximately Is.. per mile, whith is, for the six vehicles, £300 per week. His overheads, which were on a comparatively small Scale, were £30 per week, so that his total expenditure was £330 and he was getting is. 3d. per mile for his vehicles, which is £375 per week revenue and a net profit of £45 per week.

"Now, you must appreciate that out of the £300 per• week operating costs a sum of £60 per week was for depreciation, so that, apart from that item, his total running costs per week for the six vehicles when covering 1,000 miles per week each, was £240 per week, which works out at 9.6d. per mile.

" In the slack period, and it was then that I called upon him, his vehicles were each running an average of only 600 miles per week. They were still costing him 9.6d. per mile, plus a total of £60 per week depreciation, that is £204. His establishment costs were unalterable, remaining at £30, so that his total expenditure was £234. ' He was still earning is. 3d. per mile for the 600 miles, se that his revenue was £225 per week, showing a loss of £9 per week, " If he had assessed his depreciation on the basis of mileage and calculated it in the same way as I have already described to you in respect of this 10-tonner of yours, he would have arrived at a figure of 2.4d. per mile for depreciation. Running 1,000 miles per week, his total vehicle operating costs would still be, as before, Is. per mile, so that his expenditure and net profit during the busy seaSon would remain unaffected and the figures I have already given you would apply. " In the slack season, however, there would be this difference. His cost per mile would still be Is., including depreciation, so that his total operating costs would be £180. Add his overheads at £30 and you get a total expenditure of £210 per week, leaving a net profit of £15 per week out of his £225 per week revenue. • That would be a more accurate picture of the way his business was going.

" So you see that where the weekly mileage fluctuates fairly widely, it is better to assess depreciation on a mileage basis as that gives a truer picture of actual earnings."