I f you befieve that the future of haulage involves different

Page 32

Page 33

If you've noticed an error in this article please click here to report it so we can fix it.

customers sharing the same trucks, there's one big logistics firm that you'll want to watch you Salvesen. The Northants-based group has nailed its colours to the shared-usernetwork mast: the only problem is that its success has been undermined by other factors. At the moment it's fair to say that the company is underperforming.

Last month it issued a warning to the City that profits for the whole of 2001 were going to be at the lower end of analyst's expectations—last September the company announced profits had fallen 17.4% over the previous six months despite a increased turnover. So what's going c at one of the oldest established tram port firms on the planet?

The history

Few transport companies can claim t go back as far as the nineteenth cer tury, but Christian Salvesen is amen them. Founded in 1846 by Norwegia brothers Christian and Theodon

ilvesen, for more than a century the impany concentrated on its shipping Ierests until an experiment with a volutionary trawler led it to acquire ; first cold store in Grimsby in 1958. By 1980, it had expanded its cold ores and introduced food-processg facilities, but the biggest growth ime in the area of distribution. In 86 it moved into non-food distribuxi for the first time and the success a frozen food distribution contract ir Marks & Spencer encouraged it set up several dedicated frozen iod and chilled distribution centres. In 1993 it moved into industrial ark in a big way with the acquisition f Swift Service, Since then it has oquired several businesses on the ontlnent, most notably DarfeuiIle in rance. Geprosa in Spain and /ohlfarth in Germany. It also has sigificant operations in the Benelux ountries and Italy, But at a time when lost of the large UK-based logistics ompanies are doing better abroad -Ian they are at home, Christian ialvesen does the opposite.

Most of the other big logistics iroviders report strong perforlances on the Continent or in the US iith pressure on margins at home. Inlike some of its rivals it has adopted closed-book approach to contract ;fork which is more risky but potenially more profitable. It has not gone into rail or Internet shopping but has invested heavily in making shareduser systems work.

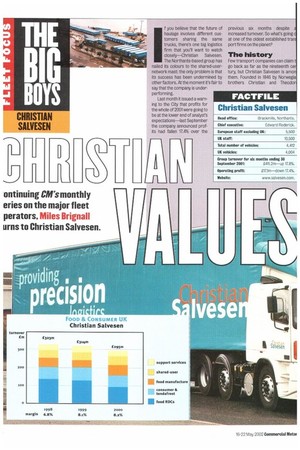

Today the company is split into two main divisions of equal size: Food & Consumer and Industrial. The undisputed star of the group is the UK's Food & Consumer division which, until the profits warning, was producing return of 8.6%. It recently signed a 10year contract with Tesco which includes the building of a £10m depot in Lincolnshire and it's clearly hoping to gain more business on the back of this investment.

The UK food division has also won or extended contracts with IKEA, Chiquita (bananas) and M&S. That side of the business doesn't look quite so promising when you look abroad, where the overall margins are less than 4%. But it is the industrial division that has the real problems, although once again the UK is leading the way.

Overall the company is dependent on engineering and automotive-based work, and its figures have suffered as those sectors have declined as part of the global slowdown in manufacturing. During the first half of 2001 the UK division recorded a profit of £7.6m on a turnover of £88.3m—Salvesen's industrial operations in France, Germany and Spain suffered an overall loss over the same period.

These problems are not new. Operations in Spain were hit hard by fuel price rises last year, coupled with a significant downturn in the automotive market there. The French subsidiary does make money but not enough, and the German industrial business lost £2.8m in the first half of 2001.

According to Salvesen's chief executive Edward Roderick (who, incidentally, is probably the best paid CEO in the logistics field, earning £351,000 last year), things are set to improve abroad. He points out that new management there is starting to turn things around and maintains that expansion on the Continent—particularly into an enlarged EU—remains the aim over the coming decade.

"We are entirely committed to Europe and believe it will become as big a market as America," he says. "Our aim will be to match our opera tions to our customers' needs in every country. If you ring me in 10 years' time I suspect our turnover here will represent the same percentage that the UK population represents to the overall EU population—that's how committed to the Continent we are."

Well placed?

Roderick sees no future for rail in Christian Salvesen operations and will stay out of the Internet shopping market until "someone can come up with a plan to make the last mile pay". Despite the poor performance recently he is upbeat about the future and suggests the company's IT systems mean it's well placed to improve.

Unfortunately, not everyone shares Roderick's enthusiasm. Those analysts who would talk about Salvesen (some consider it too small) were decidedly cool. 'It's all a big mess," says one. "They've got themselves into terrible problems with their acquisitions abroad and they need to take some action soon."

Another generously suggested that the company might have been unlucky with its purchases and pointed out that the nature of its work (shared user and closed book) was always going to leave it more exposed at times of economic downturn than some of its competitors—which is exactly what has happened.

Generally they feel the company is going to have to buy and perform a whole lot better on the Continent if Roderick is going to realise his European dreams.

Undoubtedly one of the best things about Salvesen is its IT systems. Ask its competitors about the firm and they all pay tribute to the work it has done in this area. In some ways it has had to, because shared user systems have to have good IT systems if they are to work and persuade cynical customers that their goods will arrive on time.

Roderick says most of the systems are now web-enabled, so customers can go into the system to see where their goods are at any time.

The other main bonus is that the company is probably right in claiming that shared-user networks will become the norm. It's the only real solution to the problem of empty running, and the potential cost savings to customers are attractive to say the least. There is evidence that customers are overcoming their initial resistance to it: as more do so, Salvesen is well placed to pick up a larger share of the work.

And finally, the chief executive. Roderick was described by one analyst as "not particularly inspiring", but he is experienced and he is well placed to influence government thinking, being on the board at the Freight Transport Association and chair of the government Road Haulage Forum's training sub group. Not a bad addition to any CV.