Although the future seems gloomy for Britain's hauliers, according to

Page 36

Page 37

If you've noticed an error in this article please click here to report it so we can fix it.

a new survey, a closer look at the figures reveals that a select few are managing to make their profits grow. Javid Cra finds out the secret of their success.

The phrases often used to describe the road haulage industry are well worn. Take your pick from catastrophic, terminal, desperate, troubled... they are all of the same ilk. So when a report into the industry concludes that only 20.5% of companies feel optimistic that turnover will increase in the next 12 months, while another 20.5% expect it to drop, it should come as no surprise.

But what is the secret behind the confidence of the upbeat 20.5%? Do they recognise the words catastrophic, terminal, desperate and troubled? Probably not. So, could the less fortunate learn from them?

Secret ingredient

The publisher of the report. Middlesbroughbased financial analyst Plimsoll Publishing, says it was based on looking at turnover figures of r,000 transport firms with annual sales of at least frm. But Plimsoll cannot pinpoint the secret ingredient of those companies who feel optimistic.

Plimsoll's David Patterson explains: "It would be too simple to say that it is the biggest firms who are the most optimistic. It is very rare to find a relationship between size and profit, as it is difficult to find a relationship between different sectors.

"There are secret successes out there in road haulage, but finding the key to their profitability is a dilemma."

However, Patterson suspects one part of the key to success is for road haulage companies to add services to their core businesses. "Put simply, just doing road haulage isn't enough anymore if you want to grow. You must add another string to your bow, such as warehousing," he concludes.

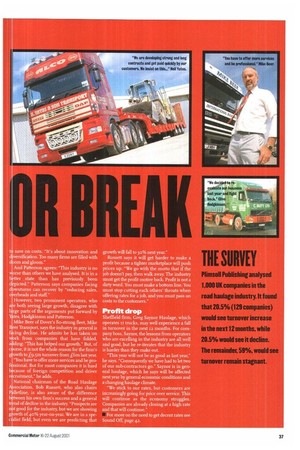

More definitive answers and lessons worth heeding come from operators approached by CM. One firm that has seen recent growth is Kent-based plant haulier N Yates 8e Son Transport. Owner Neil Yates identifies one key area behind his firm's success: "You have to be a specialist transporter to survive now. Every Tom, Dick and Harry wants a truck and they all want to do a job for nothing. That and the influx of foreign hauliers means general haulage is now a very difficult business."

N Yates 8c Son has grown by 400% over the past 12 months, with six new vehicles being added to the fleet. Clearly the percentage figure is exaggerated by the fact that the company is small—the fleet consists of just in vehicles. However, Yates is obviously doing something right.

"We have developed a substantial customer base. We are developing strong and long contracts and we get paid quickly by our customers. We insist on this, we have good staff who are paid to chase this money at 30 days or sooner. We are on the tail of companies. You can't rely on bank managers remaining friendly to you!"

Finding an "extra string" has also been fundamental to Yates' business plan. The firm has decided to use some of its new vehicles for international groupage work, finding loads via the Internet."

So, will the firrn's growth continue over the next 12 months? Yates says he likes to be optimistic, but this year will be a cautious one. "We could. easily buy new trucks and employ new drivers tomorrow, although they would vary in quality The problem is finding a return."

Professionalism

It seems that professionalism is the key for companies to grow. "We could move into buying warehouses, but at present it is too expensive. We will press on and improve our service, then try to expand next year."

Clive Hodgkinson, of 3 oo-vehicle strong general haulier C Butt Northern, shares Yates' belief that companies can flourish in the haulage industry. "Too many firms sit around moaning and groaning," he says. "We decided to re-evaluate our business last year and fight back."

Hodgkinson says his firm has subsequently brought in new IT systems, found additional business with existing customers and has looked into contract fuel agreements to save on costs. "It's about innovation and diversification. Too many firms are filled with doom and gloom."

And Patterson agrees: "This industry is no worse than others we have analysed. It is in a better state than has previously been depicted." Patterson says companies facing downturns can recover by "reducing sales, overheads and staff" However, two prominent operators, who are both seeing large growth, disagree with large parts of the arguments put forward by Yates, Hodgkinson and Patterson.

Mike Beer of Dover's 8o-strong fleet, Mike Beer Transport, says the industry in general is facing decline. He admits he has taken on work from companies that have folded, adding: "This has helped our growth." But, of course, it is not the whole reason for the firm's growth to £9.3m turnover from _gm last year.

"You have to offer more services and be professional. But for most companies it is hard because of foreign competition and driver recruitment," he adds.

National chairman of the Road Haulage Association, Bob Russett, who also chairs Palletline, is also aware of the difference between his own firm's success and a general trend of decline in the industry. "Prospects are not good for the industry, but we are showing growth of 4o% year-on-year. We are in a specialist field, but even we are predicting that growth will fall to 30% next year."

Russett says it will get harder to make a profit because a tighter marketplace will push prices up. "We go with the motto that if the job doesn't pay, then walk away. The industry must get the profit motive back. Profit is not a dirty word. You must make a bottom line. You must stop cutting each others' throats when offering rates for a job, and you must pass on costs to the customers."

Profit drop

Sheffield firm, Greg Saynor Haulage, which operates it trucks, may well experience a fall in turnover in the next 12 months. For company boss, Saynor, the lessons from operators who are excelling in the industry are all well and good, but he re-iterates that the industry is harder than they make out.

"This year will not be as good as last year," he says. "Consequently we have had to let two of our sub-contractors go." Saynor is in general haulage, which he says will be affected next year by general economic conditions and a changing haulage climate.

"We stick to our rates, but customers are increasingly going for price over service. This will continue as the economy struggles. Companies are already closing at a high rate and that will continue."

For more on the need to get decent rates see Sound Off, page 42.