THE great smokescreen of almost unintelligible financial proposals which spewed

Page 22

If you've noticed an error in this article please click here to report it so we can fix it.

from the Chancellor's bag last week allowed one very important "enemy weapon" to slip into the economic war almost unnoticed. It certainly was not attacked and it became fully operational last Friday.

The extra 7ip on hydrocarbon oil, dery to most operators, is probably the greatest single burden many operators have had to bear. Its effect on operating costs is anything from ip to lip per mile.

This is much more damaging than the petrol increase of lp per gallon—even that will increase operating costs from 0.03p to 0.06p per mile.

Counter-attack

The RHA's counter-attack on the dery increase didn't even merit a mention in the national press. Here it is verbatim: "The Road Haulage Association is dismayed at the increase of 7ip a gallon in the tax on diesel fuel. It will mean an average of three per cent on road haulage costs, a total cost of £150 a year which will have to be borne by the community as it works its way through to the price of goods in the shops.

"Owing to the adverse economic situation many hauliers have been compel led over the past year to lay up vehicles or in some cases to go out of business.

"To increase the taxation risks accelerating this trend, although operators will naturally have no option but to pass the additional cost to their customers."

Perhaps like the rest of us the RHA has become immunised to tax increases. It may be that the initial shock stunned those responsible for such things at its headquarters, but surely the point has been missed.

What the tax means is that those who operate vehicles will subsidise the country to the tune of another £75 for every 1,000 gallons of dery they buy. Of course, it will be passed on to the customer— but because of the cash •and credit system which operates in the industry, the operator never recovers his costs.

Subsidising

When 5,000 gallons of fuel are delivered, the cost, including the tax, is paid. That means that the operator has paid £375-plus on tax.

There are few operators who are paid by their customer when they do a job, some pay within six weeks, the normal period is three months. The operator is, therefore, subsidising the country by £375 on every 5,000 gallons he consumes, and in real terms he never gets the money back.

Take an operator with 10 vehicles covering 1,500 miles per week each and returning 7mpg. The vehicles will cover 195,000 miles in 13 weeks and consume about 28,000 gallons. At 7ip this will mean a constant outlay of over £2,000 to pay out on the new tax. The excise tax which was in existence before the Budget was 22ip per gallon, and on these calculations the full excise tax will mean that our 10-vehicle man will have a constant outlay of £10,400 a quarter on tax alone.

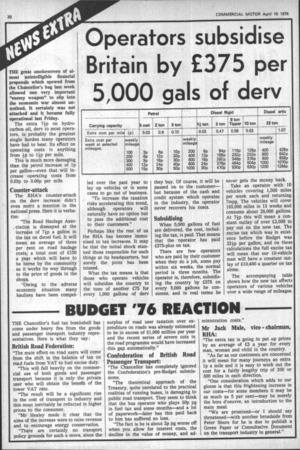

The accompanying table shows how the new tax affects operators of various vehicles over a wide range of mileages.