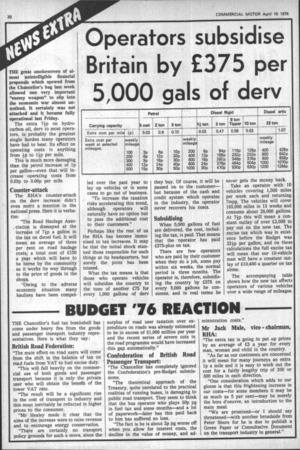

BUDGET '76 REACTION

Page 22

If you've noticed an error in this article please click here to report it so we can fix it.

THE Chancellor's fuel tax bombshell has come under heavy fire from the goods and passenger transport industry representatives. Here is what they say :

British Road Federation:

"The main effect on road users will come from the shift in the balance of tax on road fuels from VAT to fuel excise duty.

"This will fall heavily on the commercial use of both goods and passenger transport because it is only the private user who will obtain the benefit of the lower VAT rate.

"The result will be a significant rise in the cost of transport to industry and this must inevitably be reflected in higher prices to the consumer.

"Mr Healey made it clear that the aims of the increase were to raise revenue and to encourage energy conservation.

"There are certainly no transport policy grounds for such a move, since the surplus of road user taxation over expenditure on roads was already estimated to be in excess of £1,000 million per year and the recent series of severe cuts in the road programme would have increased this gap automatically."

Confederation of British Road Passenger Transport:

"The Chancellor has completely ignored the Confederation's pre-Budget submissions.

"The theoretical approach of the Treasury, quite unrelated to the practical realities of running buses, is damaging to public road transport. They seem to think that the bus operator who plays 30p pg in fuel tax and some months—and a lot of paperwork—later has this paid back to him has suffered no loss.

"The fact is he is about 2p pg worse off when you allow for interest costs, the decline in the value of money, and ad ministration costs."

Mr Jack Male, vice chairman, RHA:

"The extra tax is going to put up prices by an average of £3 a year for every man, woman and child in the country.

"As far as our customers are concerned it will mean for many journeys an extra lp a mile and it is easy to work out the cost for a fairly lengthy trip of 200 or 300 miles in each direction.

"One consideration which adds to our gloom is that this frightening increase in our costs—for some members it may be as much as 5 per cent—may be merely the hors d'oeuvre, an introduction to the main meal.

"We are promised—or I should say threatened—with another broadside from Peter Shore for he is due to publish a Green Paper or Consultative Document on the transport industry in general."