Crash for cash

Page 50

Page 51

If you've noticed an error in this article please click here to report it so we can fix it.

Collisions staged for insurance fraud are becoming more common. James Heath, the director of counter-fraud strategy for Keoghs Solicitors, explains what can be done to fight this crime.

Words: James Heath Research by the Insurance Fraud Bureau (IFB) indicates that between 1999 and 2006, more than 22,500 staged and induced motor incidents took place in the UK.

Here's how it works. Fraudsters perform unexpected and unnecessary manoeuvres which cause innocent drivers to collide with them. Several claims arc then made to the victim's insurer, including damage to the fraudster's vehicle and fictitious injuries sustained by the driver and alleged passengers.

These bogus claims can net fraudsters up to £30,000 a time, and this cost is transferred to policy holders through higher insurance premiums. The IFB estimates the cost of motor fraud at £1.5bn per year, which adds 5% to everyone's cover.

Suspicious claims

The Keoghs Solicitors counter-fraud team, based in Coventry, is employed by major insurers to investigate thousands of suspect claims every year. Claims are flagged as suspicious when they show a combination of similarities to previous fraudulent claims. For example, there might be inconsistencies in accounts of the incident, the behaviour of the claimants may appear unusual, or the incident may follow the same pattern as other known frauds.

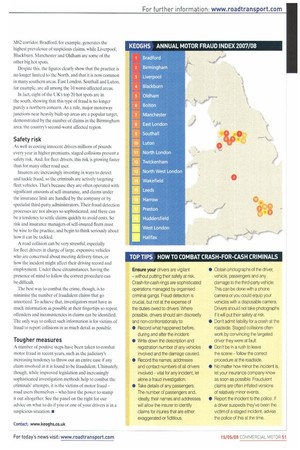

Analysis of how many suspicious claims are made in each postcode region in the UK provides an illustration of where motorists are most at risk (see panel).

The figures show that motor fraud is still most prevalent in the north of England, especially along the M62 corridor. Bradford, for example, generates the highest prevalence of suspicious claims, while Liverpool, Blackburn. Manchester and Oldham are some of the other big hot spots.

Despite this, the figures clearly show that the practice is no longer limited to the North, and that it is now common in many southern areas. East London. Southall and Luton, for example, are all among the 10 worst-affected areas.

In fact, eight of the UK's top 20 hot spots are in the south, showing that this type of fraud is no longer purely a northern concern. As a rule, major motorway Junctions near heavily built-up areas are a popular target, demonstrated by the number of claims in the Birmingham area, the country's second-worst affected region.

Safety risk

As well as costing innocent drivers millions of pounds every year in higher premiums, staged collisions present a safety risk. And, for fleet drivers, this risk is growing faster than for many other road user.

Insurers are increasingly investing in ways to detect and tackle fraud, so the criminals are actively targeting fleet vehicles, that's because they are often operated with significant amounts of self-insurance, and claims under the insurance limit are handled by the company or by specialist third-party administrators. Their fraud detection processes are not always so sophisticated, and there can be a tendency to settle claims quickly to avoid costs. So risk and insurance managers of self-insured fleets must be wise to the practice, and begin to think seriously about how it can be tackled.

A road collision can be very stressful, especially for fleet drivers in charge of large, expensive vehicles who are concerned about meeting delivery times, or how the incident might affect their driving record and employment. Under these circumstances, having the presence of mind to follow the correct procedure can be difficult.

The best way to combat the crime, though, is to minimise the number of fraudulent claims that go unnoticed. To achieve that, investigators must have as much information as possible at their fingertips so repeat offenders and inconsistencies in claims can be identified. The only way to collect such information is for victims of fraud to report collisions in as much detail as possible.

Tougher measures

A number of positive steps have been taken to combat motor fraud in recent years, such as the judiciary's increasing tendency to throw out an entire case if any claim involved in it is found to be fraudulent. Ultimately, though, while improved legislation and increasingly sophisticated investigation methods help to combat the criminals' attempts, it is the victims of motor fraud — road users themselves — who have the power to stamp it out altogether. See the panel on the right for our advice on what to do if you or one of your drivers is in a suspicious situation. •