TDG's outstanding year...

Page 51

If you've noticed an error in this article please click here to report it so we can fix it.

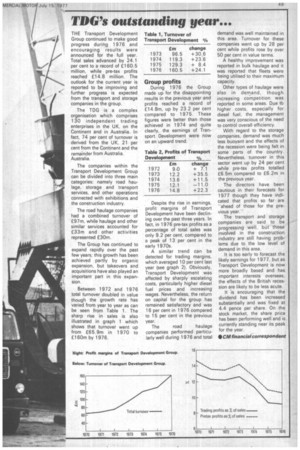

THE Transport Development Group continued to make good progress during 1976 and encouraging results were announced for the full year. Total sales advanced by 24.1 per cent to a record of £160.5 million, while pre-tax profits reached £14.8 million. The outlook for the current year is reported to be improving and further progress is expected from the transport and storage companies in the group.

The TDG is a complex organisation which comprises 130 independent trading enterprises in the UK, on the Continent and in Australia. In fact, 74 per cent of turnover is derived from the UK, 21 per cent from the Continent and the remainder from Australia. Australia.

The companies within the Transport Development Group can be divided into three main categories: namely road haulage, storage and transport services, and other operations connected with exhibitions and the construction industry.

The road haulage companies had a combined turnover of £97m, while haulage and other similar services accounted for £33m and other activities represented £30m.

The Group has continued to expand rapidly over the past few years; this growth has been achieved partly by organic expansion, but takeovers and acquisitions have also played an important part in this expansion.

Between 1972 and 1976 total turnover doubled in value though the growth rate has varied from year to year as can be seen from Table 1. The sharp rise in sales is also illustrated in graph 1 which shows that turnover went up from £65.9m in 1970 to £160m by 1976.

Group profits

During 1976 the Group made up for the disappointing results in the previous year and profits reached a record of £14.8m, up by 23.2 per cent compared to 1975. These figures were better than those achieved in 1974 and quite clearly, the earnings of Transport Development were now on an upward trend.

Despite the rise in earnings, profit margins of Transport Development have been declining over the past three years. In fact, in 1976 pre-tax profits as a percentage of total sales was only 9.2 per cent, compared to a peak of 13 per cent in the early 1970s.

A similar trend can be detected for trading margins, which averaged 10 per cent last year (see graph 2). Obviously, Transport Development was affected by sharply escalating costs, particularly higher diesel fuel prices and increasing wages. Nevertheless, the return on capital for the group has remained satisfactory and was 16 per cent in 1976 compared to 15 per cent in the previous year.

The road haulage companies performed particularly well during 1976 and total demand was well maintained in this area. Turnover for these companies went up by 28 per cent while profits rose by over 50 per cent in value terms.

A healthy improvement was reported in bulk haulage and it was reported that fleets were being utilised to their maximum capacity.

Other types of haulage were also in demand, though increasing competition was reported in some areas. Due to higher costs, especially for diesel fuel, the management was very conscious of the need to control overall efficiency.

With regard to the storage companies, demand was much less buoyant and the effects of the recession were being felt in some parts of the country. Nevertheless, turnover in this sector went up by 24 per cent while pre-tax profits totalled £6.5m compared to £6.2m in the previous year.

The directors have been cautious in their forecasts for 1977 though they have indicated that profits so far are "ahead of those for the previous year."

The transport and storage companies are said to be progressing well, but those involved in the construction industry are still having problems due to the low level of demand in this area.

It is too early to forecast the likely earnings for 1977, but as Transport Development is now more broadly based and has important interests overseas, the effects of the British recession are likely to be less acute.

It Is encouraging that the dividend has been increased substantially and was fixed at 4.4 pence per share. On the stock market, the share price has been performing well and is currently standing near its peak for the year.

• CM financial correspondent