OPINIONS FROM OTHERS

Page 74

Page 75

If you've noticed an error in this article please click here to report it so we can fix it.

Consideration for the Petrol-electric Vehicle.

The Editor, THE COMMERCIAL MOTOR.

[2786] Sir,—We are more than grateful to you for drawing attention in your issue of April 30th to the Budget proposal to exclude from the electrically propelled vehicle class those of the type which derive their source of power from an engine carried on the vehicle itself.

We consider that this proposal, which eliminates the petrol-electric vehicle from the benefits already given to the electrically propelled vehicle, is unfair, in the sense that no credit is given to the vehicle for its smoothness of running, absence of gearbox noises, and the lessened wear and tear on the roads.

Whether the petrol-electric vehicle be entitled to a. rebate of more or less than 50 per .cent, of the tax chargeable on goods-carrying vehicles is not for us to say, but we prefer to endorse your opinion that some measure of encouragement should be accorded to the petrol-electric principle, rather than to accept the implication of the present Government that the system is not entitled to any consideration whatsoever.

Moreover, we believe that the remission of taxation already granted to users of pneumatic-tyred vehicles is a principle which should be followed and that the virtues peculiar to the petrol-electric transmission should be acknowledged in the shape of a reduction not alone on goods vehicles but also on those employed in pawenger carrying.—Yours faithfully, W. R. STIEPHARD (Managing Director, Tilling-Stevens Motors, Ltd.). Maidstone.

Roads and the Vehicles which Use Them.

Time Editor, THE COMMERCIAL MOTOR.

[2787] Sir,—In view of the great attention which is being given at the pre.sent time to all matters in connection with the construction and maintenance of roads in this country, the following facts may be of interest to your readers :— 1. There are 178,914 miles of road in Great Britain, of which 41,200 miles are Class I and Class JI roads.

2. The number of mechanically propelled road vehicles in Great Britain has grown from 873,700 in 1921 to 2,052,453 in 1928.

3. During the twelve months ended December 31st, 1927, 13,040,000 tons of granite and limestone, . produced from quarries in Great Britain, were used for roadmaking purposes as compared with 12,029,605 tons used in the previous year.

4. The amount of money for grants to road works has increased from £12,480,000 in 1924-5 to £18,130,000 in 1928-9.—Yours faithfully,

(Sin) ARTHUR It, HOLBROOK, 3I.P. House of Commons.

Calculating Interest on First Cost.

The Editor, THE COMMERCIAL MOTOR.

[2788] Sir,—The letter signed by "Transport Manager," under the above heading, and the view expressed by the Editor raise a point which in my experience has been the subject of many prolonged arguments. In the first place, I would rather accept "Transport Manager's" method of calculating interest on the depreciative value of the vehicle, although, in fact, I have heard the view expressed many times that Interest on capital should not enter into operating costs at all. For this reason, that when a commercial

e44 vehicle is purchased it is with the object of saving the money spent in hiring or in rail transport, and the money thus saved immediately becomes a profit. Similarly, in the ease of a haulage contractor, the machine is purchased in order to earn profits. It seems to me, therefore, that the money spent cannot be described as anything else but an investment, since it is spent with the sole object of making a profit, and what is profit but interest on capital?—Yours faith fully, T.W.

Yorks. The Editor, THE COMMERCIAL MOTOR.

[2789] Sir,—With reference to letter No. 2774, appearing in your issue dated April 30th, "Transport Manager" is correct. The depreciation is theoretically, and should be practically, back in the business earning 5 per cent, or more; otherwise where is the cost of the new lorry coming from ?—Yours faithfully, London, W.1. ANON.

The Editor, THE COMMERCIAL MOTOR. • [2790] Sir,—With regard to your comments on "Transport Manager's" letter, No. 2774, it would be interesting to have the opinion of some of your readers on this point. Personally, I have for some years adopted "Transport Manager's " practice, and I venture to think that his method will be approved by the majority of your readers.

If your illustration be logically followed and the first cost considered from the interest-charge point of view as an investment, then the depreciation charges should be considered as a partial realization of such investment, the aniount realized being expended for services rendered.

It is then legitimate to calculate the interest charge on the depreciated value only.

To be consistent, under your method, it would be necessary when replacing a vehicle to calculate the interest charge for the new purchase on the sum of its first cost plus the amount of depreciation written off the first cost of the vehicle replaced.—Yours faithfully, London E.C.2. ANOTHER T.M.

[The laws by which accountancy is governed are by no means as inviolable or unalterable as those of the Medes and Persians. It is, indeed, a custom a most businesses and trades to vary them to meet their own special requirements, and that usage is sufficient justification for a transport manager dealing with the item of interest on first cost in the manner suggested by this and a previous correspondent—if he be so Inclined. It is, as a matter of fact, within my knowledge that this practice is not uncommon. At the same time, there can be no doubt that it is not, strictly speaking, correct. The interest on capital expenditure must always be calculated on the full amount of the capital expended. The very description of the item is an argument to that end.

The point raised by this correspondent, i.e., that the further purchase of a new vehicle adds another sum of equal, or approximately equal, amount to that originally invested, does not in any way diminish the truth of the fundamental law, although it still remains that the amount to be debited under this head to any particular vehicle is the interest on the first cost of that vehicle alone, without the addition of that appertaining to any predecessor.

It may clear the air a little if I invite consideration of the following circumstances : A vehicle is bought with a sum the major part of which is derived from a bank overdraft. Let us assume that this overdraft —or other accommodation ot.suitable nature, if you will—stays undisturbed throughout the life of the vehicle. Will the bank be willing to diminish the interest on that overdraft progressively as the value or the vehicle depreciates?—S.T.R.] The Use of Foreign Road Material.

The Editor, THE COMMERCIAL MOTOR.

[2791] Sir,-1 am glad to avail myself of Sir Cooper Rawson's invitation in your issue of April 30th to Liberal candidates to state their views on the use of foreign roadstone in the Lloyd George scheme to reduce unemployment to normal proportions within one year.

To ask the potential Liberal Government to deliver itself in advance into the hands of the British quarryowners and guarantee to use only their products, without qualification as to suitability and price, is to ask for a guarantee which (as Sir Cooper Rawson knows perfectly well) no loyal authorities or county surveyors will give to-day, however patriotic they may be or however much they prefer British roadstone.

The British quarryowners buy the bulk of their macninery at home, but would they give a guarantee to use only British machinery in their quarries? Or are they Free Traders when buying and Protectionists when selling?

Similarly, British local authorities buy the bulk of their stone at home and the little they buy abroad is probablythought there for the same reasons that the quarryowners buy some of their plant abroad.

Sir Cooper Rawson does not mention the present proportion of imported roadstone to the total amount used, but in 1926 he himself was told by Colonel Ashley in the House of Commons that the imported tonnage "represented less than one-sixtieth of the total consumption of roadstone in Great Britain."

Is there any reason to suppose that anything but profiteering or inability to obtain at home what was required for the new roads would lead British road surveyors to buy a much increased proportion of foreign stone, which most of them regard as inferior, for most purposes, to British?

If not, then all but this minute proportion of the stone required for the new roads would be bought from British quarries. It would be a greater quantity than the British quarries have ever been asked to provide before and I fancy that they would quickly

forget about foreign imports in their anxiety to equip their quarries to deal with the new demands upon them.

Or would they play dog-in-the-manger and insist on work on the roads being held up—and employment of roadrnakers and transport workers prevented—until such time as their quarries were able to supply that which could be obtained abroad immediately?—Yours faithfully, H. J. HAMBLEN (Prospective Liberal Candidate for Reigate), Reigate.

The Transport of Awkward Loads.

• The Editor, THE COMMERCIAL MOTOR.

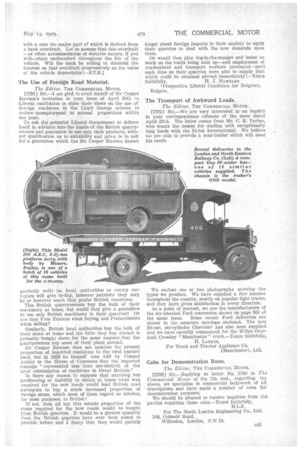

[2792] Sir,—We are very interested in an inquiry in your correspondence columns of the issue dated April 23rd. The letter comes from Mr. C. E. Varian, who wants the means for dealing with exceptionally long loads with the 31-ton International. We believe we are able to provide a semi-trailer which will meet his needs.

We enclose one or two photographs showing the types we produce. We have supplied a fair number throughout the country, mostly on popular light trucks, and they have given satisfaction in every direction. As a point of interest, we are the manufacturers of the six-wheeled Ford conversion shown on page 361 of the same issue. Some recent Ford deliveries are shown in the separate envelope enclosed. The new 30-cwt. six-cylinder Chevrolet has also been supplied and we have recently commenced for the Willys Overland Crossley "Manchester" truck.—Yours faithfully, H. LARKIN, For Truck and Tractor Appliance Co. (Manchester), Ltd.

Cabs for Demonstration Runs.

The Editor, THE COMMERCIAL 111070R.

[2793] Sir,—Replying to letter No. 2780 in The Commercial Motor of the 7th inst., regarding the above, we specialize in commercial bodywork of all descriptions and have made a number of cabs for demonstration purposes. We should be pleased to receive inquiries from the parties requiring these cabs.—Yours faithfully,

H.L.F.

Willesden, London, NAVA°.