Cutting down on your smoking

Page 28

Page 29

If you've noticed an error in this article please click here to report it so we can fix it.

The Chancellor has promised special tax rates for low emission trucks from early 1998. But which vehicles will qualify—and how will they be tested? The DOT is looking for some answers with a consultation document. Commercial Motor picks out the stumbling blocks.

What comes out of a truck exhaust is bad for your health, That's why the Government wants to reduce the level of particulates (soot) produced by HGVs. Last November Chancellor Kenneth Clarke promised to "reduce Vehicle Excise Duty by up to £500 per year for lorries meeting very stringent emission standards". The intention is to introduce the tax concessions by early 1998.

But what those "stringent standards" are is anybody's guess. A fortnight ago the Department of Transport published a consultation paper "Vehicle Excise Duty Incentive for Lorries meeting Low Emission Standards" to find out what operators think they should be, and how they could be measured and enforced. Here are the key issues that need to be resolved.

SIANDAIDS

Before the DOT hands out any concessions it has to set a clear particulate emission standard for any tax break. It says: "The most straightforward and preferred qualification would be a single absolute standard". It suggests a level of 0.03 grams per kilowatt hour (g/k1Vh). This represents 20% of the allow

ii•HE TARGET ii•HE TARGET

The DOT has older vehicles in its sights when reducing particulate emissions—for good reason. According to its own statistics 71.5% of all HGVs are more than Five years old while more than 10% are over 10 years old. And, despite the advent of tighter emission standards, fewer than 30%—

kapbout 120,000—meet the old Euro-1 ndard, never mind Euro-2, ' In its consultation document it states at 'There is obvious concern about the most polluting vehicles—the pre Puro-1 vehicles..." Although it accepts that as more operators buy cleaner Euro-2 trucks "...the overall emission levels will decline progressively..." it adds: "This process is inevitably a slow and partial one. The molar purpose of a VED incentive therefore is to reduce particulate emissions from existing vehicles."

The department believes that VED incentives will encourage operators to fit particulate traps to older trucks and g.,.reduce pollution.

It able particulates produced by a Euro-2 engine (see chart) and only 8% of the particulates generated by a Euro-1 engine rated at more than 85kW. In other words pre Euro-1 engine exhausts need a lot more after-treatment if they're to get down to 0.03g/kWh. As an alternative the DOT proposes 0.07gkW/h (or 20% of the Euro-1 standard) but admits that although this would be achievable by many older trucks fitted with particulate traps it "might be too easy for Euro-2 vehicles to achieve—indeed many may be able to reach it without any additional equipment."

There could also be "dual absolute limits" whereby the permissible particulate level for pre-Euro-1 trucks would be higher than for that on Euro-1 and 2 engined models. However, enforcing this would be a nightmare.

Finally there's the option of a standard based on an overall percentage reduction in a truck's emissions—the VED concession being granted if the truck's exhaust after-treatment equipment art particulates by 80%. But that would mean a more complicated testing procedure and the possibility of a Euro-2 engine vehicle without a trap still having lower particulate emissions that a pre-Euro-1 wagon fitted with one, but not qualifying for a concession.

Marsham Street suggests there could first be a visual inspection which would "show that additional equipment had been fitted, this combined with an emissions check, could provide sufficient proof". Unfortunately there's a lot of difference between how new engines are certified, and old ones tested. Before a truck gets Type Approval its engine has to undergo a rigorous test to EC directive (88177/EK) which demands a detailed analysis of its exhaust— not just particulates.

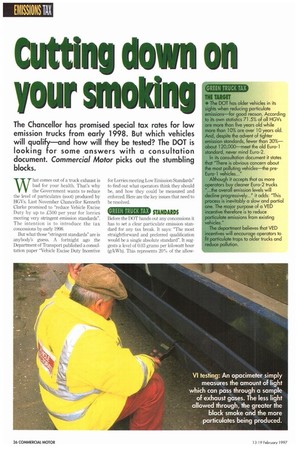

Conversely, the free acceleration smoke check (FAS) carried out by the Vehicle Inspectorate in an annual test uses an opacimeter which simply measures the amount of light which can pass through a sample of exhaust gases. The less light allowed through, the greater the black smoke and the more particulates being produced. The former is analytical. The latter is controversial. Undeterred the DOT says: "The current in-service smoke test could be used to identify non-functioning exhaust cleaning equipment..." and it invites views on "testing the level of particulate emissions and the correlation between very low smoke meter readings and the level of particulate emissions.' In other words it might have an idea on what standards to set but it doesn't know whether it could measure them with existing VI equipment. And if you can't measure particulates accurately you can hardly award a concession.

IMLIMIED CERTIFICATION

Assuming it can decide on a limit, and a way to test it, the DOT says that VED concessions could be awarded either by a vehicle inspection or self-declaration. The former would mean having it checked at a VI test station although the cost to an operator could be reduced if this coincided with the annual test.

If the DoT can't find a reliable in-service test it might approve specific equipment which would be checked by the VI and possibly also tested through the FAS. It would then issue a certificate for a small initial fee of around £13.50.

You'd then send your certificate to either the DVLA or take it to a local vehicle registration office (VRO) to support your application for the concessionary tax class.

Self-declaration would involve fitting a particulate trap, applying for a tax concession, then having it checked at the next annual test. But the DOT warns that operators would face a stiff penalty if they falsely claimed any VED reduction.

Although self-declaration would minimise the regulatory burden if the VI had to check VED status at an annual test fees could increase.

To retain a concession, vehicles would have to be inspected by the VI, preferably at the same time as the annual test. This would attract a small extra charge.

g/kWh=grams per kdoyeatt how

NOW MUCH?

What would you get off your VED if you fitted a particulate trap? The answer is not much when set against the cost of a trap. The DOT is saying "up to £500" would be available with the options being: a flat rate reduction to all vehicles, subject to a minimum VED rate; a percentage reduction for all trucks ; or concessionary bands based on vehicle weights.

IIMEM110 WHAT WOULD YOU NEED?

Given the DOT's desire to reduce particulates from existing, older vehicles the most obvious option would be for an operator to fit a regenerative particulate filter which traps, and then burns off the soot particles, or a catalytic convertor in the exhaust system (CM39 October 1996).

Costs vary between £2,000-E.4,000. The alternative is to switch to a cleaner fuel such as CNG or LPG.

A gas conversion could add a further £8,000415,000 to the price of a medium-size truck without taking account of infrastructure costs.

El by Brian Weatherley