gi i_ m ra a n r spcj man agement guide

Page 90

Page 91

If you've noticed an error in this article please click here to report it so we can fix it.

COSTS THAT

COUNT (9) by David Lowe,

MInstTA, AMBIM THE reader who has followed this series may now be convinced of the wisdom of instituting a system for costing his vehicle operations. In this case some suggestions on how to start will be useful.

In starting a vehicle costing system a little groundwork must be undertaken to ensure the success of the scheme. First, all the staff who are in any way likely to be involved (in a small company this may only involve the proprietor and his drivers) must be "sold" on the reasons for starting the scheme and their support must be won.

Next, in considering what documentation to use — and a certain amount is inevitable — the following seven points should be kept uppermost in mind: 1, it must be properly planned; 2, it must suit the business; 3, it must be simple; 4, it must be inexpensive in labour and materials; 5, it must be the minimum necessary to give the required result; 6, it must give the required result;

7, it must be kept up to date.

It should also be remembered that the only purpose in preparing these cost figures (and any other figures come to that) is to use them to make the business more profitable. Any figures produced which do not achieve this aim are best forgotten and the time spent on more productive pursuits in connection with the business.

So far as documentation is concerned, in most businesses many of the basic informa

tion source documents are already in use. Examples are: drivers' record sheets, fuel issues from bulk stock or receipts from outside suppliers, workshop time /job sheets or invoices from outside repairers, wages records, copy sales invoices and a daily summary of the fleet working. All these documents, whatever their basic style, contain information which can be usefully employed in the costing system. Where they don't provide all the necessary information required very often a slight alteration can be made to allow for the item to be included without the need for introducing new and additional paperwork.

Driver's record sheets, for example, are required by law in most cases and while it is not a legal requirement for daily mileage and fuel issues to be recorded on them such information may just as well be obtained on this document as from an additional one. Vehicle earnings, drivers' wages, subsistence payments and other drivers' expenses could also be added to the records in an extra column after the sheets have been handed in so that these sheets would provide a substantial proportion of the costing data.

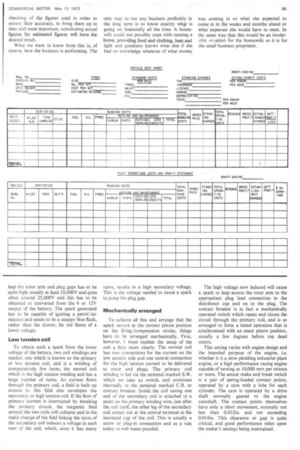

Two specially prepared documents are all that is really required to operate a simple system. One is a monthly individual vehicle cost sheet, the other is a monthly fleet operating statement. Examples of how such forms may be laid out are shown on the facing page.

Before it is possible to complete all the information required on the forms the stand

ing, establishment and running costs for the vehicles (as described in parts (2), (3), (4), and (5) of this series) need to be calculated. The best way to do this is to make a schedule of all the vehicles in the fleet listing their original cost, their present-day worth and their anticipated remaining life. The vehicle's carrying capacity and its estimated annual mileages should also be shown. The annual fixed costs of the vehicle can be listed (ie tax, insurance, depreciation, etc) and added to give the total standing cost.

Running costs will need to be calculated from estimations as indicated in article (5) (CM April 14). Fuel consumption can be calculated by taking the fuel issues over a period — from full tank to full tank — divided by the mileage covered. Tyre life can be estimated and repair costs can be estimated initially or the figure taken from the previous year's audited accounts with a margin added for inflation. The establishments costs can also be taken from previous accounts and increased by a suitable margin.

Having collected these figures together and entered them where appropriate on the forms the results will give an indication of the profitability or otherwise of individual vehicles and the fleet as a whole.

I have deliberately used the term "indication" because in the first instance it will only have been possible to use, in some cases, estimated figures. A good, accurate costing system will take some considerable time to establish but constant monitoring and checking of the figures used in order to ensure their accuracy, to bring them up to date and most important, substituting actual figures for estimated figures will have the desired result.

What we want to know from this is, of course, how the business is performing. The only way to run any business profitably in the long term is to know exactly what is going on financially all the time. A housewife could not possibly cope with running a home, providing food and clothing, heat and light and goodness knows what else if she had no knowledge whatever of what money

was coming in or whit she expected to come in in the weeks and months ahead or what expenses she would have to meet. In the same way that this would be an intolerable ,;ituation for the housewife so it is for the small business proprietor.