€7111 DOLE... King Coal is but a shadow of his

Page 56

Page 57

If you've noticed an error in this article please click here to report it so we can fix it.

former self. The Government might help stave off the industry's demise, but few hauliers are prepared to keep too many of their eggs in this shrinking basket...

lealt another blow last month smokeless fuel production lbercwmboi, South Wales was dosed with the loss of 70 jobs. The lecision to shut the plant, by Coal )roducts of Chesterfield, was a esult of "a steady decline in the narket for domestic solid fuel, ihich, when combined with inseasonably mild winter weather, las created excess capacity". Structural changes to the industry ire the result of the Government's neve, through privatisation, to bring he size of the industry into line with mticipated future demand. According to Dave Parry, research ifficer with the Coalfield :ommunities Campaign, one of the nost damning blows to the industry las been the rise in gas-fired power ;enerators which have received hefty nvestment in the "dash for gas". ilso, imported coal is often cheaper han UK deep-mined coal.

The eleventh-hour deal over RIB las struck because the Government lid not want further job losses and iroblems to the electrical supply ndustry, claims Parry. For the future UB has said that it wants to be able o target the export market

The most important issue is what ;going to happen to the coal indusry long-term, says Parry. Do we lbandon coal completely and depend olely on gas, relying on imports from ilaces like the Middle East which is iolitically volatile? That is what we all hould be considerine. he warns. The coal industry received a stay of execution last year when the Government stepped in to avert a potential crisis over pit closures and heavy job losses. The Government brokered short-term deals between the UK's largest mining company, RJB, and the electricity generators to ensure coal's future until important energy reviews were completed.

But now that eleventh-hour reprieve could be in jeopardy as last month the Government admitted that one key review would not be ready until July—and the short-term emergency contracts come to an end in June. If nothing is done, RJB faces a huge problem of over-capacity once again and the threat of eight colliery closures with massive job losses will rear its head once more.

Steady decline

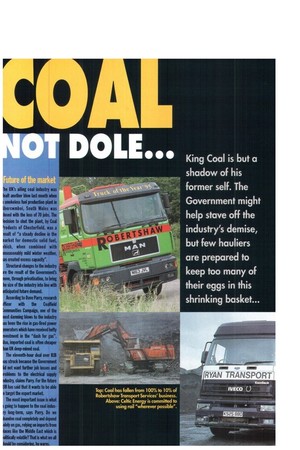

But bulk hauliers working for coal mining firms around the country remain philosophical about the steady decline in demand for coal. Garth Robertshaw, managing director of Robertshaw Transport Services, near Newark, says: "Everything has its day—steam, oxen, now even the internal combustion engine might be on the way out. You can't stop evolution." Robertshaw believes that coal's future lies as a specialist fuel for customers such as cement companies.

Robertshaw has seen coal haulage die away over the years to the extent where it now accounts for about 10% of his business— it used to be 100%. He cites many reasons for the change; small users such as schools and hospitals turning their backs on coal as a fuel to generate boilers; the environmental lobby's attack on coal over pollution and health fears; and rail's ability to offer competitive rates for long-haul coal movements.

Add to this the political back-drop of pit closures and investment in gas-fuelled power generators and it is easy to understand that today's hauliers are chasing the remnants of a once fruitful market. "There's a bit of work around, but nothing like the volumes there were," says Robertshaw.

He muses over the past when work was available all year round: in the summer hauliers were used for building up stocks ready for the winter. "Nobody keeps stocks any more," he says ruefully.

Over the past couple of years South Wales haulier Ryan Transport, part of Cardiff Bulk Handling Services, has diversified into shipping in order to survive. Group chairman Tony Davies warns other hauliers reliant on the dwindling coal market to "look at other things". About 60% of Ryan Transport's business involves moving coal and coke, but new companies have been set up within the group to deal with stevedoring and cargo handling to offer a complete European transport service. In its heyday the company had more than 100 tippers working solely on coal transport. Its fleet's mix and size reflects what has happened to the industry: there are now 32 vehicles, including artics, swaps, flats and trailers.

Both Ryan Transport and Den-based Alan Price & Sons work for Celtic Energy, the second largest coal producer in the UK, which was formed when the management of British Coal Opencast {South Wales} bought the operations from the Government as part of the privatisation process. Finance manager Mary Rudge sees the change in the market when she is preparing the books and bidding in for contracts.

Lowest price

"When we put our prices in for a job with Celtic Energy they have to be fixed so it depends how desperate you are for your lorries to be working," says Rudge. "Sometimes you might have to put your lowest price in, just to keep them ticking over."

About 15 years ago around 90% of Price's work was in coal haulage but, again, the company has been forced to look elsewhere. Waste turned out to be a partial solution. Price bought two ejector trailers which it uses on work for waste management firm Biffa. Moving product For Pioneer Aggregates also helps. "The coa market is definitely dwindling," says Rudge. RJB Mining, with the largest slice of the mar ket in the UK, says 80% of its product is trans ported by rail. The rest is picked up by truc from local mines, but that's still lean pickings fo tipper operators. "This has certainly affect-. the tipper market," says Davies. Celtic Energy i • also committed to using rail "wherever possi ble", says the company. "At Celtic Energy w: use subcontractors to move large volumes o coal to and from distribution centres along wit bulk movements by rail to markets."

One Preston tipperman, who doesn't wish t• be named, insists there is still work to be had i coal for the wily. When foreign imports arrive a the docks, for example, hauliers are needed And he disputes the success of rail in lurin• away road traffic, claiming that some rail firm • do not have the wagons to cope with th: demand. "Rail just isn't up to it," he says. "I West Cumbria they lout trains on for freight o Tuesdays and Thursdays, but the rest of the tim hauliers are used."

Bad news

Just before Christmas there was more ba . news for the coal industry: over-capacity ti the tune of 10 million tonnes of coal hit home However, the agreement with the electrici generators will enable the collieries t. maintain production until June. This migh shelve the over-capacity problem in the short term but, as RJB admits, nothing is certai about production after that date.

RJB and bulk hauliers are all awaiting th: outcome of a whole raft of Government review • on power supply, one of which will concentrat: on electricity trading. Among the contractors moving coal for RJ: Mining is Hargreaves Distribution, based i Woodlesford, Leeds. Transport manager Pau Sharp says thot before the privatisation of th: industry, up to 40% of the company's work wa for British Cool. But since privatisatio Hargreaves does about 10% for RIB Minin• and the rest is for power generators.

And Sharp warns that even haulage to power generators has a question-mark hangin. over it "In the long-term there are rumours tha power stations face closure so it's difficult t. gauge what will happen."