A. Model Form of Trading an rofit and Loss Account

Page 28

Page 29

Page 30

If you've noticed an error in this article please click here to report it so we can fix it.

Third and Concluding Article of a .Series Pointing Out the -Deficiencies of Trading and Profit 'and Loss Accounts as Usually Prepared and Indicating How They Should Be

Made Out

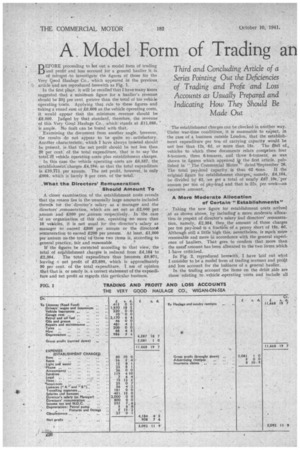

BEFORE proceeding to het out a model form of trading and profit and loss account for a general haulier it is of inte;pst -to investigate' the figures of those for the Very qood Haulage Co., which appeared in the previous,

article and are reproduced herewith as Fig. 1. •

In the first place, it will be recalled that! have many times suggested that a minimum figure for a haulier's revenue should be 331 per cent. greater than the total of his vehicle operating 'costs. Applying that rule to these figures and taking a round sum of £6,600 as the vehicle operating costs, it would appear that the minimum revenue should be

• £8,890. Judged by that standard, therefore, the revenue of this Very Goo,d Haulage Co., which' stands at £11,668, 'is ample. No fault can be found with that.

Examining the document from another angle, however, the results do not appear to be quite so. satisfactory. Another characteristic, which I have always insisted should be present, is that the net profit should be not less than 20 per cent: of the total expenditure, that is to say 'the total. et vehicle operating costs plus establishment charges. In this case the vehicle operating costs are £6,587, the establishmenecharges £4,184; so that the total expenditure is £10,771 per annum. The net profit, however, is only £908, which is barely 9 per cent, of the, total.

,What the Directors' Remuneration Should Amount To

A closer examination of the establishment costs reveals -that the reason lies in the unusually large amounts included -therein' for the • director's salary as a manager and the directors' remuneration, which are set out as £2,000 per annum and £800 per Annum respectively. In the case of an organization of this size, operating no more than 10 vehicles, it is not usual for the director's salary as manager to exceed £800 per annum or the director* remuneration to exceed £200 per annum. At least, £1,000 per annum as.the total of those two items is, according to general practice, fair and reasonable.'

If the -figures be corrected according to that view, the total of establishment charges is reduced from £4,184 to £2,384. The total expenditure thus becomes £8,971, leaving a net profit of £2,699, which is approximately 30 per cent, of the total expenditure. I am of opinion that that is or nearly is, a correct statement of the expenditure and net profit as regards this particular business.

The establishment charges can be checked in another way. Under. war-time conditiOns. it is reasonable to expect, in the case of a business outside London, that the establishment expenditure per ton of carrying capacity would be

not less than 12s. 6d. or more than 15s. The frea of 0, vehicles to which these documents relate comprises four 5-tonners, three 6-tonners, and three' 8-tonners. as was shown in figures which appeared if the first article, published in "The Commercial Motor '• dated 'September 26.

The total pay..load capacity is thus 62 .tons If the original figure for establishment charges, namely, £4,184, .be divided by 62, we get a total of nearly £67 10s. per annum per ton of pay-load and that is 27s. per week—an excessive amount, A More Moderate Allocation

of Certain "Establishments" Taking the new figure for establishment costs arrived at as shown above, by including' a more moderate allocation in respect of director's salary and directors' remuneration, namely, £2,384, then the amount of those charges per ton pay-load is a fraction of a penny short of 15s. 6d. Although still a little high this, nevertheless, is nutch more reasonable and more in accordance with the general experience of hauliers, That goes to confirm that more than the usuaramount has been allocated to -the two items which I have criticized.

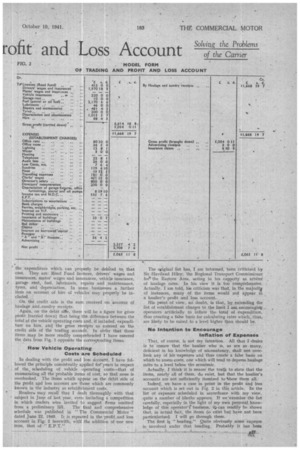

In Fig. 2, reproduced herewith, I have laid out what I consider to be a modelform of trading account and profit and loss account for the buhiness of a general haulier.

In the trading account the items on the debit side are those relating to .vehicle .operating costs and include all the expenditure which can properly be debited to that cost. They are: Road Fund licences, drivers' wages and insurances, mates' wages and insurances, vehicle insurance, garage rent,, fuel, lubricants, repairs and .maintenance, tyres, and depreciation. In some businesses a further item on account of hire of vehicles may properly be inchided.

On the credit side is the sum received on account of haulage and .sundry receipts.

Again, on the debit silk, there will be a figure for gross profit (carried down) that being the difference between the total of the vehicle operating costs and, if included, expenditure on hire, and the gross receipts as entered on the credit side of the trading accourit. In circler that these items may he more readily comprehended I have entered the data from Fig. 1 opposite the corresponding items.

• Now Vehidlo Operating Costs are Scheduled In dealing with the profit and loss account, 1 have followed the principle consistently applied fof years in respect of the, scheduling of vehicle operating costs—that of enumerating all the probable items of cost, so that none is overlooked. The items which appear on the debit side of the profit apd loss account are those which are commonly known in the industry as establishment costs.

Readers may recall that I dealt thoroughly with that subject in June of last year, even including a competition in which readers were invited to suggest Items omitted from a preliminary ligt. The final and comprehensive schedule was published in "The Commercial Motor" dated June 22, 1940. It is repeated in the 'profit. and loss account in Fig. 2 herewith, with' the addition of one new item, that of " E.P.T.."

The -original list has, I am informed, been criticized by Sir -Havilaud Hiley; 'the Regional Transport CommissiOner foil' the Eastern Area, acting in his capacity as arbiter of haulage rates. In his. view it is too comprehensive. Actually, I am told, his criticism was that, in the majority of instances, many of the items would not appear in

a haulier's profit and loss account. ' His point of view, nO doubt, is that, by extending the . . list of establishment charges to the limit I arn encouraging operators artificially to inflate the total of expenditure, thus creating a false basis for calculating rates which,, thus, are likely to be raised to a level higher than should be.

No Intention to Encourage Inflation of Expenses That, of course, is not my intention. All that I desire is to ensure that the haulier who is, as are so -many, deficient in his knowledge of accountancy, shall not overlook any of his expenses and thus create a false basis on which to assess costs, one which will tend to depress haulage rates to a level below the econiamic. • .

Actually, I think it is nearer the truth to state that the items, nearly all of them, do exist, but that the haulier's accounts are not .sufficiently itemized to 'show them all.

Indeed, . w have a case in point in the. profit and loss account which is set out in Pig. 2 in this_ article. In the list of expenses scheduled in accordance with my view. quite a number of blanks appears. If we'eicamine the list carefully, especially in the light of my own personal knowledge of this operator'' business, iteca.n readily be shown that, in actual fact, the items do efist 'but have not been particularized. I will go through them. The 'first is "heating." Quite obviously some expense is. involved under that heading. Probably it has been

included in "lighting," because the premises are heated by gas fires.

The second is " E.P.T." At the time this profit and loss' account was drawn up there had been no expenditure under that.heading. It will almost certainly be found in that operator's accounts to.-day.

The third, "subscriptions to associations," undoubtedly exists, because I know that the operator is a'member of such associations. • In all probability his expenditure under that head has been included under ' sundries " which, at £119 6s, 10d.,. are rather excessive.

The next, one is " bank charges " which, obviously, are inescapable. This item„ also, is probably submerged in sundries. • As td'" ferries, weighbridges, parking. •etc.," I do know that this„ operator has to meet expenses under that head.

Here, again, I am afraid " sundries " is' responsible.

There is no place in this haulier's business for " interest

• on H.P." That is a legitimate omission. On the Other hand, he certainly must spend a fair amount on printIng

and stationery. • I should imagine also that, from . time to time, he is

• put to some expense in respect of "maintenance of buildings." It may be .that the, terms on the contractunder which he rents his premises are such that the proprietor is responsible for maintenance hut, having in mind those premises and the rent as set out in thisprofit and loss account, I doubt it.

As regards the next two items "bad debts" and " claims " I do 'mow that this operator is fortunately placed and is unlikely to be put to any expense under either of those' two headings. Very few, however, escape the first, although the second will not figure in all accounts.

As to the next item, "'interest on borrowed capital," some explanation of its absence is to be found in the balance sheet which was published in • " The Commercial Motor" dated September 26. This operator is working on capital wilich he has himself put into the business, and it may be that he is charging his business no interest on the amount, E1,124, which he has put into it: It is, nevertheless, an item which will appear in the majority of profit and loss accounts.

1 he next item, "postage" is again one which, obviously, must exist. It is probably included in " sundries." • The final heading, " advertising " does not exist in this case, but will do so in many hauliers' accounts.

So that out of 14 items which are blank in this case at least seven should have appeared. The absence of one of them, " E.P.T.," was temporary, and that of three' of the others is due to the particularly favourable conditions under which this haulier operates. I think; therefore, I have made' out a good case for the scheduling of all of those I enumerate.

In conclusion, I suggest that the form as set out in this article be standardized and that all the items therein shown be included. No harm is done by putting blanks where, in a particular. case, the item does not exist.

The outcome of this standardization would be a more accurate •preSentment of hauliers' expenditure in a form which can be particularly useful, especially in the days to _come, when the question of economic rate's is likely to become more and more prominent. For .the assessment of such rates the first eSsential is a reduction of all hauliers' costs to a common basis, so that comparisons can easily be made. One step towards this desirable objective is the adoption of a universal system. S.T.R.