Model Profit and Loss Accou :* a Haulier's Business

Page 42

Page 43

If you've noticed an error in this article please click here to report it so we can fix it.

IN my contribution last week, I stated that " I have never yet seen what I regard as a satisfactory Trading Account and Profit and Loss Account relating to a

haulier's business. I now propose to indicate bow, in my opinion, such accounts should be drawn up, so that they can be used as a help to the haulier in running his business. Here is the basis of my criticism of those documents, as they are usually prepared. For the sound assessment of rates for haulage an operatoi wishes to know, with reasonable accuracy, what are his vehicle operating costs and his charges. It is essential that he knows his vehicle costs, free from any complication brought about by the inclusion of extraneous items that are net precisely vehicle-operating costs, because, otherwise, he cannot be sure that his machines are working as economically and as efficiently as they might be.

Actually, that information should be available more directly in his operating cost records, and it is not so much that aspect of the matter which at present I wish to stress. He requires precise knowledge of his establishment charges, free from items which are actuall, vehicle-operating costs, so that he can check them, take steps from time to time to reduce them, and allocate them in proper proportion amongst the units of the fleet, so that each vehicle can carry its own burden of those charges.

He should be able to take this information direct from his trading and profit and loss account, without any necessity to analyse those accounts and separate those items germane to each of these two important sections. My criticism of each document of this nature which I have inspected is that the information is not set out so that the operator can do this: I am not, in *hat I am saying, or in the modifications I am about to suggest, implying that there is need for the slightest deviation from ordinary accountancy practice in the preparation of these documents. On the contrary, I contend that the strictest application of that practice would result in the presentation of these accounts in precisely the form which I consider to be desirable.

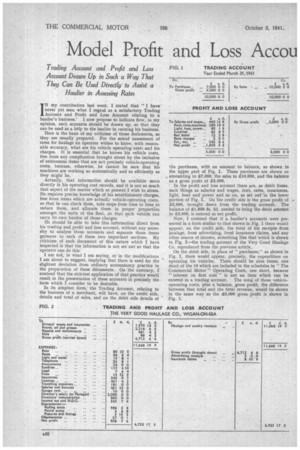

In its simplest form," the Trading Account, relating to the business of a merchant, will have, on the credit side, details and total of sales, and on the debit side details of the purchases, with an amount to balance, as shown in the upper part of Fig. 1. These purchases are shown as amounting to £7,000, the sales to £10,000, and the balance as a gross profit of £3,000. In the profit and loss account there are, as debit items, such things as salaries and wages, rent, rates, insurances, light, heat and power and so on, as set out' in the lower portion of Fig. 1. On 'the credit side is the gross profit of £3,000, brought down from the trading account. The balance of £1,858 3s. 5d. needed to bring the debit amount to £3,000, is entered as net profit.

Now, I contend that if a haulier's accounts were presented in a form similar to that shown in Fig. 1 there would appear, on the credit side, the total of his receipts from haulage, from advertising, front insurance claims, and any other source of income, something like that which is shown in Fig. 2—the trading account of the Very Good Haulage Co. reproduced from the previous article. On the debit side, in place of " purchases," as shown in Fig. 1, there would appear, precisely, the expenditure on operating his vehicles. There should be nine items, one short of the 10 which are included in the schedules in " The Commercial Motor " Operating Costs, one short, because "interest on first cost " is not an item which can be

entered in a trading account, The total of those vehicleoperating costs, plus a balance, gross profit, the difference between that total and the total revenue, would be shown in the same way as the £3,000 gross profit is shown in Fig. 1.

On the debit side of the profit and loss account would then appear all the items of establishment charges and the total of these, plus a balance which will actually be the net profit will equal the gross profit brought down from the trading account.

Now, in the previous article I stated that the trading account and profit and loss account of the Very Good Haulage Co. was nearly what I regard as ideal or, at any rate, was as near as any I had yet seen. There has clearly been some attempt to segregate vehicle-operating costs from establishment charges, but whoever was responsible for drafting the account has not gone all the way in direction.

I should, perhaps, recall the nine items of operating costs which, in my opinion, must appear on the debit side of he trading account. They are Road Fund tax; drivers' and mates' wages, including insurance; garage rent; vehicle insurance; expenditure on fuel; lubric,ants; tyres and maintenance;' depreciation.

If the trading account of the Very Good Haulage Co. be

examined it will be noted that only four of these 10 items are included. ,Possibly there are, in effect, five, as it appears to be this operator's practice to include expenditure on tyres under repairs and maintenance.

If we accept that, there are still four items missing. There is the Road Fund tax; this is probably included in the item " licences" at £451 4s. 2d., which appears under " expenses." There is insurance, and this probably is included in the item totalling £243 Os. 7d. There is garage rent which appears as £10, and there is depreciation, which is set down as. £986 5s, 6d. .

We cannot be sure, In so far as licences and insurances are concerned, that the amounts indicated represent expenditure on only those items. They may, include some other things as well, so that before we can arrive at our ideal document for this company it is necessary to analyse those two accounts and see what they do include.

Unfortunately, I have not .the detail figures relating to these items, but from a knowledge of the business and of the' number of vehicles, I think it is not 'unreasonable to take, for the total amount for Road Fund licences, £415, leaving £36 4s. 2d, as expenditure on A and B licences under the Road and Rail Traffic Act. I think the vehicle incur ance probably totals £220, leaving £23 Os, 7d. as the amount spent on fire and other insurances. These amounts have been entered accordingly in the redrafted trading and profit and loss account shown as Fig. 3. I have brought the item of £10 for garage rent up from the profit and loss account to the trading account, also the depreciation of rolling stock amount—£986 55. (Id.

I have made some alterations in the trading account, in that I have separated expenditure on petrol and oil fuel from that of oils and greases and made two items instead of one. Similarly, I have added the item" tyres" and deducted an approximately appropriate amount of £200 from thee £681 4s. 2d. entered in the old account against repairs and maintenance.

The total on the debit side of the trading account is now £6,587 18s. 7d. That is really the total of operating costs and compares with £4,956, approximately, which was all that was debited to it in the previous account., The account for gross profit is now diminished from £6,712 6s. 6d. to 25,081 Is. Od.

This gross profit, brought down, is entered on the credit side of the profit and loss account and, together 'with two other small items, gives a total of £5,092 I Is. 9d., which is also the total on the debit side of the profit and loss account. It should be noted that the amount of net profit, £908 7s. 6d., remains unaffected.

Let us now see what we have in this new arrangement of the trading account and profit and loss account.

First of all, note that the figure for total revenue and that for net profit are unaffected. They are still as before, which, of coarse,. is at it should be.

Next, note that it is possible for the operator to take directly from this document the three items of information which are essential if he is to be able properly .to assess his rates on a logical basis. He has his total vehicle operating costs, £6,587 18s. 7d. He has his total of establishment charges, £4,184 4s. 3d. He has his net profit, £.908 7s. 6d. The practical use to which this information can be put and a further development of this suggestion of mine for a properly arranged trading account and profit and loss account must form the Subtect of another article.