EMMA

Page 44

Page 45

If you've noticed an error in this article please click here to report it so we can fix it.

CHILL WIND OF CHANGE

What's the future for road transport? Are hire-or-reward hauliers having it their own way—or are own-account operators still fighting them off? Commercial Motor's biennial industry survey will bring cheer to some, and despair to others. But whether you're a big fleet or an owner-driver, the times are definitely changing...

FI very two years CMS parent company Reed Business Information sponsors a major survey of the road transport industry. The researchers' brief is simple: find out what's going on in our world. Why do we want to know? If CM is to deliver the best editorial to our readers we need to know what's happening to them, and not just on a daily news basis.

As with previous surveys we've asked Peter Cooke, director of the Centre for Automotive Management research at Henley Management College, to help us interpret the results. So what's happening?

The good news is that the demand for road transport capacity continues to grow in terms of goods carried and delivery schedules. The industry is also making better use of its vehicles; not only through better unit load usage, but also by more effective control of its trucks.

Better exploitation

The bad news, says Cooke, forcefully, is that "Simple road haulage has been condemned to history. In its place is a sophisticated road haulage and logistics industry which is reducing the number of units in operation and seeking even better exploitation of each unit."

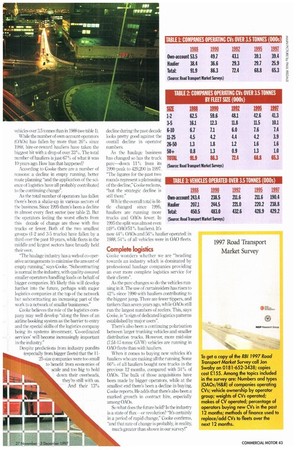

Our 1997 Road Transport &Inn highlights some

remarkable strategic changes which have taken place over the past 10 years The most obvious is

that today there are 29% fewer 0licence holders

operating vehicles over 3.5 tonnes than in 1988 (see table 1).

While the number of own-account operators (0A0s) has fallen by more than 26% since 1988. hire-or-reward hauliers have taken the biggest hit with a drop of over 33%. The total number of hauliers is just 67% of what it was 10 years ago. How has that happened?

According to Cooke there are a number of reasons: a decline in empty running, better route planning "and the application of the science of logistics have all probably contributed to the continuing change".

As the total number of operators has fallen there's been a shake-up in various sectors of the business, Since 1995 there's been a decline in almost every fleet sector (see table 2). But the operators feeling the worst effects from this decade of change are those with five trucks or fewer. Both of the two smallest groups (1-2 and 3-5 trucks) have fallen by a third over the past 10 years, while fleets in the middle and largest sectors have broadly held their own.

The haulage industry has a web of co-operative arrangements to minimise the amount of empty running," says Cooke. "Subcontracting is normal in the industry; with quality-assured smaller operators handling loads on behalf of bigger companies. It's likely this will develop further into the future, perhaps with major logistics companies at the top of the network but subcontracting an increasing part of the work to a network of smaller businesses."

Cooke believes the role of the logistics company may well develop "along the lines of an airline booking system as the barrier to entry and the special skills of the logistics company being its systems investment. 'Co-ordinated services' will become increasingly important in the industry."

Despite predictions from industry pundits (especially from bigger fleets) that the 1125-size companies were too small to benefit from economies of scale and too big to hold down their overheads, they're still with us. And their 13% decline during the past decade looks pretty good against the overall decline in operator numbers.

As the haulage business has changed so has the truck p2trc-down 11% from its 1990 peak to 429,2(X) in 1997. "The figures for the past two rounds represent a plateauing of the decline," Cooke reckons, "but the strategic decline is still there."

Haulier 207.1 Total: 450.5 While the overall total is little changed since 1995, hauliers are running more trucks and CMOs fewer. In 1995 the split was almost even (49% 0A0/51% hauliers). It's now 44% ()MN and 56% haulier operated: in 1988, 54% of all vehicles were in 0A0 fleets.

Complete logistics

Cooke wonders whether we are "heading towards an industry which is dominated by professional haulage companies providing an ever more complete logistics service for their clients".

As the part changes so do the vehicles running in it. The use of curtainsiders has risen to 42% since 1990 with hauliers contributing to the biggest jump. There are fewer tippers, and tankers than seven years ago, while CMOs still run the largest numbers of reefers. This, says Cooke, is "a sign of dedicated logistics patterns established by major users".

There's also been a continuing polarisation between larger trun king vehicles and smaller distribution trucks, However, more mid-size (7.51-17-tonne GVW) vehicles are running in 0A0 fleets than with hauliers.

When it conies to buying new vehicles it's hauliers who are making all the running. Some 66% of all hauliers bought new trucks in the previous 12 months, compared with 34% of CIA0s. The bulk of those acquisitions have been made by bigger operators, while at the smallest end there's been a decline in buying, Cooke reports. He adds that there's also been a marked growth in contract hire, especially among °AO& So what dos, the future hold? Is the industry is a state of flux---or revolution? "It's certainly in a period of rapid change," Cooke confirms, "and that rate of change is probably, in real it y, much greater than shown in our survey!"