Hot profits

Page 28

Page 29

If you've noticed an error in this article please click here to report it so we can fix it.

Whether you are a trans-frontier specialist or a UK operator considering the merits of adding international routes to your portfolio of services, pundits believe that chilled and frozen food transport offers rich pickings once the Channel Tunnel is operating in tandem with the Single European Market.

The expected rates and services battle between ferry operators and the Channel Tunnel has been much delayed, but temperature-controlled operators are already being targeted as volume users of the tunnel.

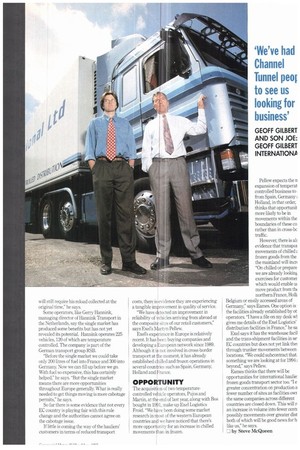

"We've had the Channel Tunnel people to see us looking for business. They still can't give us a rate. All that they can say is that they are going to be competitive," says Geoff Gilbert, managing director of Lincolnshirebased Geoff Gilbert International, Le Shuttle is the company which will operate the service. It confirms that it sees perishable foods as a growth sector for its business. This, it says, is because of the timesensitive nature of the goods and the speed which the service will provide.

However, operators have yet to be convinced about the benefits of the tunnel by rail or road. "The work we've done looking at movement of chilled products through the tunnel on rail has lacked guarantees on service levels for terminal to terminal movements by train. Whether or not it will improve the road vehicles coming through on the shuttle remains to be seen and there are still issues such as price to be decided," says Martyn Pellew, marketing and IT director at Exel Logistics.

Temperature-controlled goods will be able to travel through the tunnel by railway wagon or by trucks aboard the tunnel shuttle service.

The 800-metre long shuttle will run initially every 20 minutes and will have space for 28 temperature-controlled vehicles each time. There will be four refrigeration plug-in points for each vehicle position.

Geoff Gilbert has been operating for 24 years and the past 15 of these has been dedicated to international movements. This is achieved using a combination of 15 owned tractor units and regular subcontractors pulling 40 refrigerated trailers.

He says that unless the tunnel rates are significantly cheaper, many operators will stick to ferries because the improved border traffic and fewer customs procedures mean that vehicles will be able to get across on the ferries as efficiently as they could by shuttle.

Not surprisingly, port and ferry operators are well advanced with plans to defend their market. Dover has already built a 7,500m2 temperature-controlled storage facility to cater for an increase in food traffic. It was opened last year. P&() European Ferries added a fifth passenger and freight ferry, The Pride of Burgundy, to its Dover to Calais route at the end of April. A new loading system has been devised for use at Dover which will enable truckers to drive directly on to the ship after only one stop.

P&O says the vehicles on the 75-minute crossing will have a check-in time about 20 minutes before the sailing. Le Shuttle says its frontier controls will be combined with the French ones at the UK end. It estimates that a vehicle leaving the motorway in the UK can be joining a motorway in France within 80 minutes, including passing through toll booths, loading and unloading

DOUBTERS

There are doubters. Hargrave International managing director Graham Eames is one. His Spalding-based outfit has been operating in the UK and on the European mainland since 1978. We think the ferries will be more than geared up to providing a competitive service and I doubt that the shuttle will be able to achieve its expected times from motorway to motorway, he says, "By the time you've joined the line and then loaded, it will take longer."

Hauliers' customers are very interested in the effect of potential time savings on transport costs, For example, since the dawning of the Single European Market on 1 January, operators have already received enquiries about rate changes.

"One or two of our customers have asked us to look at the difference the single market has made to our costs. I don't know of any international drivers who are paid by the hour, so a saving of two, three or even four hours does not really make much difference," says Fames.

For the moment at least, time savings are out of step with costs. "Everything has a timed collection and a timed delivery. Even if you arrive a little early, the chances are that the customer will still require his reload collected at the original time," he says.

Some operators, like Gerry Hannink, managing director of Hannink Transport in the Netherlands, say the single market has produced some benefits but has not yet revealed its potential. Hannink operates 225 vehicles, 120 of which are temperature controlled. The company is part of the German transport group RSB.

"Before the single market we could take only 200 litres of fuel into France and 300 into Germany. Now we can till up before we go. With fuel so expensive, this has certainly helped," he says. "But the single market means there are more opportunities throughout Europe generally. What is really needed to get things moving is more cabotage permits," he says.

So far there is some evidence that not every EC country is playing fair with this rule change and the authorities cannot agree on the cabotage issue.

If little is coming the way of the hauliers' customers in terms of reduced transport costs, there is evidence they are experiencing a tangible improvement in quality of service.

"We have detected an improvement in reliability of vehicles arriving from abroad at the composite sit.:!s of our retail customers," says Exel's Marlyn Pellew, Exel's experience in Europe is relatively recent. It has been buying companies and developing a European network since 1989. Although it is not involved in cross-border transport at the moment, it has already established chilled and frozen operations in several countries such as Spain, Germany, Holland and France.

OPPORTUNITY

The acquisition of two temperaturecontrolled vehicle operators. Pujos and Martin, at the end of last year, along with Bos bought in 1991, make up Exel Logistics Froid. "We have been doing some market research in most of the western European countries and we have noticed that there's more opportunity for an increase in chilled movements than in frozen. Pellew expects the n expansion of temperat controlled business to from Spain, Germany ; Holland, in that order, thinks that opportunit more likely to be in movements within the boundaries of these co rather than in cross-bc traffic.

However, there is al: evidence that transpoi movements of chilled frozen goods from the the mainland will incn "On chilled or prepare we are already lc-xikin exercises for customer which would enable tit move product from th( northern France, Holk Belgium or easily accessed areas of Germany," says Eames. One option is the facilities already established by ot operators. "I have a file on my desk wi gives me details of the Exel Logistics' distribution facilities in France," he so

Exel says it has the warehouse facil and the trans-shipment facilities in se EC countries but does not yet link thei through trwiker movements between locations. "We could subcontract that. something we are looking at for 1994 ; beyond," says Pellew.

Eames thinks that there will be opportunities for international haulie frozen goods transport sector too. "I e greater concentration on production a fewer number of sites as facilities owr the same companies across different countries are closed down. This will n an increase in volume into fewer cenn possibly movements over greater dist both of which will be good news for h like us," he says.

by Steve McQueen