BOUNCING BACK INTO ACTION

Page 134

Page 135

If you've noticed an error in this article please click here to report it so we can fix it.

• Crane Fruehauf, Britain's biggest trailer manufacturer, claims to be bouncing back after a gloomy September, which saw it shed 300 staff and launch an extendible semi-trailer — just as the Government decided to give the green light to 13.6m trailers a year earlier than planned.

The cuts have made the Norfolk-based company "leaner and fitter" for the 1990s, says public affairs manager Graham Thomson. With the industry facing a downturn, Crane Fruehauf has made the redundancies in time to revise its plans for the next decade — plans which include several new designs.

Thomson is confident about prospects for the convertible trailer, launched at Freight 89 in Torquay last month.

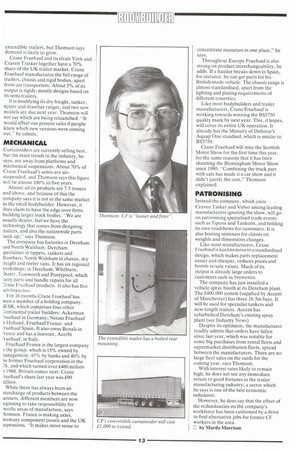

The curtainsider, built to 12m and extendible to 13.6m, was meant to ease the change to longer lengths when they

became legal in January 1991. However, with the Government's about turn meaning 13.6m trailers will be allowed from next year, it looked as if the manufacturer's initiative had flopped. Who would want a 12m trailer when a new 13.6m version could be bought now, at less cost, and run legally from January?

Thomson admits the announcement put a dampener on the launch, but is confident the model will sell to operators running tri-axle tractive units now, and who need a shorter trailer to operate within maximum vehicle lengths. When the tractor is replaced, say after two years, the longer-life trailer can be extended and hitched to a two-axle unit.

Roads and Traffic minister Robert Atkins hopes that bringing the date forward will improve prospects for trailer manufactures, all of which will be faced with cutting jobs due to higher interest rates and a slowing of the economy, Thomson predicts. But he says the move will affect only a small part of the market mainly those who bulk-out before weighing-out.

The extendible trailer has a thinner neck — 184mm rather than the standard 218mm — triple king pin positions and a moveable suspension which changes the centre line of the bogie to trailer rear from 4,220mm to 4,080mm. The curt ainsided body has a bolted rear whith allows a pre-assembled roof extension to be fitted.

The curtainsider will cost a total of £1,750: down payment of £750 and a £1,000 charge to convert. A 12m flat convertible will cost £500 initially, with another £250 to bring it up to 13.6m. So far Crane Fruehauf has sold three of the

extendible trailers, but Thomson says demand is likely to grow.

Crane Fruehauf and its rivals York and Craven Trasker together have a 70% share of the UK trailer market. Crane Fruehauf manufactures the full range of trailers, chassis and rigid bodies, apart from car transporters. About 5% of its output is rigids; mostly designs based on its semi-trailers.

It is modifying its dry freight, tanker, tipper and drawbar ranges, and two new models are due next year. Thomson will not say which are being relaunched. "It would affect our present sales if people knew which new versions were coming out." he admits.

Curtainsiders are currently selling best, but the main trends in the industry, he says, are away from platforms and mechanical suspensions. About 70% of Crane Fruehauf's semis are airsuspended, and Thomson says this figure will be almost 100% in five years.

Almost all its products are 7.5 tonnes and above, and because of this the company says it is not in the same market as the small bodybuilder. However, it does claim to have the edge over firms building larger truck bodies. "We are usually dearer, but we have the technology that comes from designing trailers, and also the nationwide parts Dack-up," says Thomson.

The company has factories in Dereham and North Walsham. Dereham ipecialises in tippers, tankers and irawbars; North Walsham in chassis, dry 'reight and reefer vans. It has six regional workshops: in Dereham, Whitburn, Dssett, Tamworth and Pontypool, which :arry parts and handle repairs for all 2rane Fruehauf products. It also has five .ub-branches.

For 18 months Crane Fruehauf has nen a member of a holding company, ;ESR, which comprises four other 2ontinental trailer builders: Ackerman 'ruehauf in Germany; Netam Fruehauf n Holland; Fruehauf France, and 'ruehauf Spain. It also owns Benals in 'ranee and has a licencee, Acerbi 'ruehauf, in Italy.

Fruehauf France is the largest company the group, which is 15% owned by lanagement, 45% by banks and 40% by he former Fruehauf corporation in the JS, and which turned over £460 million 1 1988. Britain comes next: Crane 'ruehauf's share last year was £90 While there has always been an iterchange of products between the artners, different members are now eginning to take responsibility for Decific areas of manufacture, says 'homson. France is making axles, iermany component panels and the UK aspensions, "It makes more sense to concentrate resources in one place," he says.

Throughout Europe Fruehauf is also strong on product interchangeability, he adds. If a haulier breaks down in Spain, for instance, he can get parts for his British-made vehicle. The chassis range is almost standardised, apart from the lighting and plating requirements of different countries.

Like most bodybuilders and trailer manufacturers, Crane Fruehauf is working towards winning the 8S5750 quality mark by next year. This, it hopes, will cover its entire UK operation. It already has the Ministry of Defence's Aquap One standard, which is similar to BS5750.

Crane Fruehauf will miss the Scottish Motor Show for the first time this year, for the same reasons that it has been shunning the Birmingham Motor Show since 1980: "Combining the truck part with cars has made it a car show and it didn't justify the cost," Thomson explained.

Instead the company, which joins Craven Tasker and Volvo among leading manufacturers ignoring the show, will go on patronising specialised trade events such as Tipcon and Tankcon, and holding its own roadshows for customers. It is also hosting seminars for clients on weights and dimensions changes.

Like most manufacturers, Crane Fruehauf is keen to move to a standardised design, which makes parts replacement easier and cheaper, reduces prices and boosts re-sale values. Much of its output is already large orders to customers such as breweries.

The company has just installed a vehicle spray booth at its Dereham plant. The £400,000 system (supplied by Accent of Manchester) has three 16.5m bays. It will be used for specialist tankers and new-length trailers. Accent has refurbished Dereham's existing spray plant (see Industry News).

Despite its optimism, the manufacturer readily admits that orders have fallen since last year, which was notable for some big purchases from rental fleets and supermarket distribution fleets, spread between the manufacturers. There are no large fleet sales on the cards for the coming year, says Thomson.

With interest rates likely to remain high, he does not see any immediate return to good fortunes in the trailer manufacturing industry; a sector which he says is one of the best economic indicators.

However, he does say that the effect of the redundancies on the company's workforce has been cushioned by a drive to find alternative jobs for former CF workers in the area.