The kiss of debt

Page 18

Page 19

If you've noticed an error in this article please click here to report it so we can fix it.

There's no getting away from the fact the UK is in a lot of debt. To pay that off, cuts have to be made in public spending. Will the haulage industry have to swallow the bitter pill of vital road projects being shelved, or are there other funding options open?

rogenbrownfarbi.co.uk

THE UK IS NOW more in debt than at any time since the Second World War.

With this in mind, the incoming government, of whatever political hue. will be forced to make some swingeing public spending cuts.

The fear in the road transport industry is that vital road building schemes will face the axe in an attempt to reduce the £178bn budget deficit.

So far, much of the talk about road budgets being under threat has been speculative, based on a leaked memo from Department for Transport (Dff) officials last summer that suggested any future government could be forced to cut £30bn from its total transport spending programme.

However, while the major political parties talk about cutting public spending, none has so far offered much concrete information about which departments will bear the brunt.

Stephen Glaister. professor of transport and infrastructure at Imperial College London, says governments will always view transport budget cuts as less painful than hitting schools and hospitals.

He continues: "Transport is capitalintensive. You can carry out short-term cuts without results being visible for quite a time." Jo Tanner, director of communications at the Freight Transport Association (FTA), says any administration that fails to provide long-term investment in the road network would be making a -big mistake': She adds: -We can't afford to think in short-term Parliamentary cycles anymore. Transport requires consistent and continuous long-term investment in transport infrastructure, not just to enhance UK plc's commercial ability, but to help us meet our national commitment to a lower carbon future.

Tanner continues: "Transport projects are labour-intensive, so, by backing these projects, we will also generate jobs and stimulate the economy."

Road Haulage Association policy director Jack Semple believes that ministers don't take road building seriously enough. "The key question is: how are we going to ring-fence transport budgets to ensure our roads are not starved of vital funds?" he asks.

Possible solutions

Although the DfT could not provide a precise costing for current and future road-building projects, a spokeswoman says that over the current three-year period, it is spending approximately £40bn on transport projects and its .E6bn roads programme is "progressing': So what are the possible funding solutions for road transport schemes?

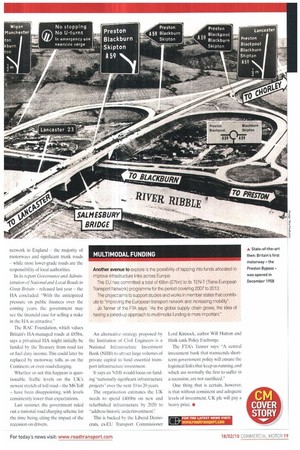

The RAC Foundation says that one option is to sell off the major roads and motorways overseen by the Highways Agency (HA) to a private company The HA is responsible for operating the 6500-mile (10.461km) strategic road network in England — the majority of motorways and significant trunk roads — while most lower-grade roads are the responsibility of local authorities.

In its report Governance and Administration of National and Local Roads in Great Britain — released last year — the HA concluded: "With the anticipated pressure on public finances over the coming years. the government may see the financial case for selling a stake in the HA as attractive."

The RAC Foundation, which values Britain's HA-managed roads at L85bn, says a privatised HA might initially be funded by the Treasury from road tax or fuel duty income. This could later be replaced by motorway tolls, as on the Continent, or even road-charging.

Whether or not this happens is questionable. Traffic levels on the UK's newest stretch of toll road — the M6 Toll — have been disappointing, with levels consistently lower than expectations.

Last summer, the government ruled out a national road charging scheme for the time being, citing the impact of the recession on drivers.

An alternative strategy proposed by the Institution of Civil Engineers is a National Infrastructure Investment Bank (NUB) to attract large volumes of private capital to fund essential transport infrastructure investment.

It says an NIIR would focus on funding"nationaliy significant infrastructure projects" over the next 10 to 20 years.

The organisation estimates the UK needs to spend ,£400bn on new and refurbished infrastructure by 2020 to "address historic underinvestmenf: This is backed by the Liberal Democrats, ex-EU Transport Commissioner Lord Kinnock, author Will Hutton and think-tank Policy Exchange.

The FTA's Tanner says: "A central investment bank that transcends shortterm government policy will ensure the logistical links that keep us running, and which are normally the first to suffer in a recession, are not sacrificed."

One thing that is certain, however, is that without consistent and adequate levels of investment, UK plc will pay a heavy price. •